Question: Please solve a) to g) using Microsoft Excel and provide formulatext screenshots by using the charts provided above begin{tabular}{|l|r|r|r|} hline & multicolumn{3}{|c|}{ AAA Inc Income

Please solve a) to g) using Microsoft Excel and provide formulatext screenshots by using the charts provided above

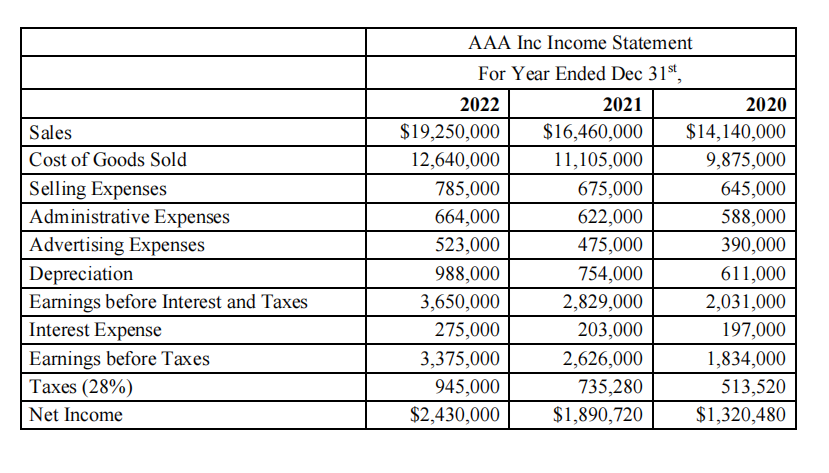

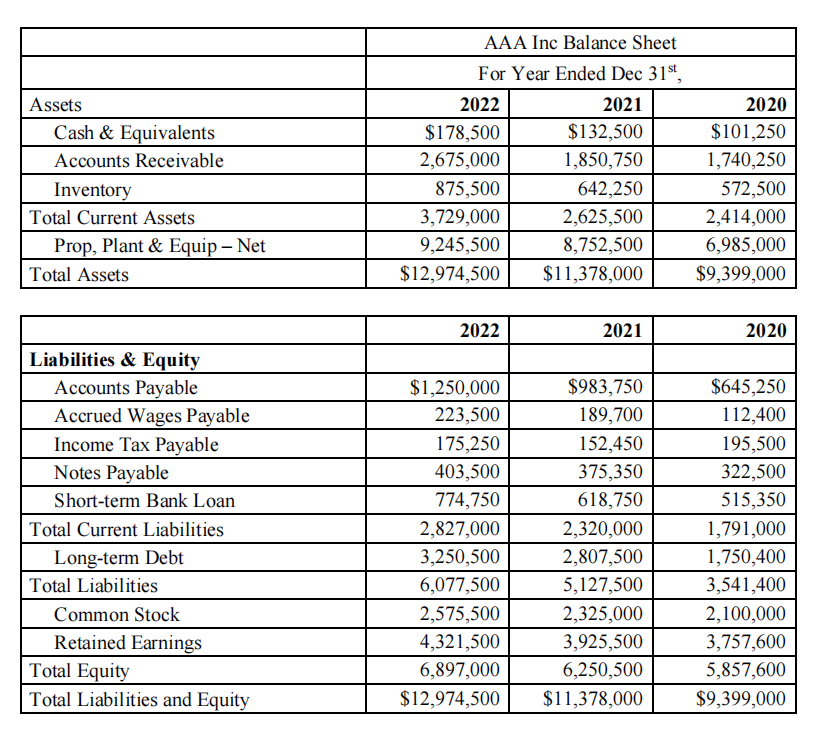

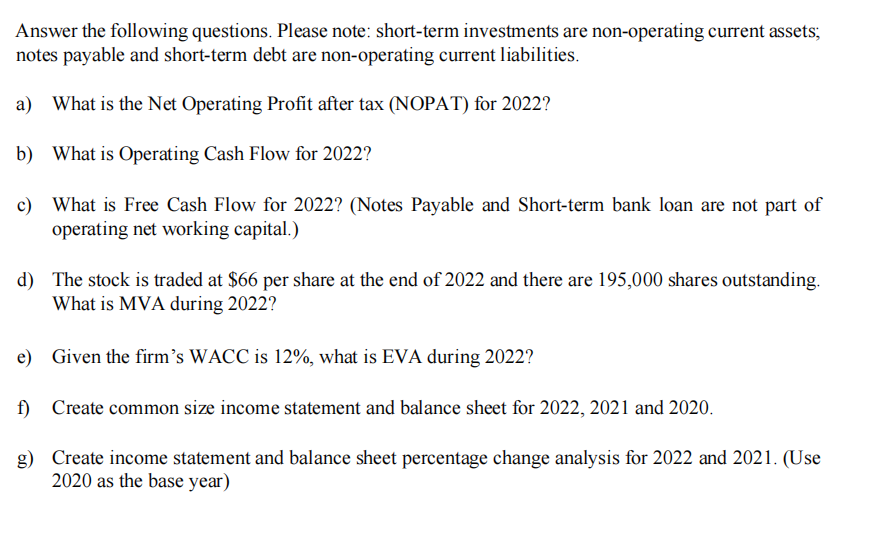

\begin{tabular}{|l|r|r|r|} \hline & \multicolumn{3}{|c|}{ AAA Inc Income Statement } \\ \hline & \multicolumn{3}{|c|}{ For Year Ended Dec 31st} \\ \hline & 2022 & 2021 & 2020 \\ \hline Sales & $19,250,000 & $16,460,000 & $14,140,000 \\ \hline Cost of Goods Sold & 12,640,000 & 11,105,000 & 9,875,000 \\ \hline Selling Expenses & 785,000 & 675,000 & 645,000 \\ \hline Administrative Expenses & 664,000 & 622,000 & 588,000 \\ \hline Advertising Expenses & 523,000 & 475,000 & 390,000 \\ \hline Depreciation & 988,000 & 754,000 & 611,000 \\ \hline Earnings before Interest and Taxes & 3,650,000 & 2,829,000 & 2,031,000 \\ \hline Interest Expense & 275,000 & 203,000 & 197,000 \\ \hline Earnings before Taxes & 3,375,000 & 2,626,000 & 1,834,000 \\ \hline Taxes (28\%) & 945,000 & 735,280 & 513,520 \\ \hline Net Income & $2,430,000 & $1,890,720 & $1,320,480 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|r|} \hline & \multicolumn{3}{|c|}{ AAA Inc Balance Sheet } \\ \hline & \multicolumn{3}{|c|}{ For Year Ended Dec \( 31^{\text {st }}} \), \\ \hline Assets & 2022 & 2021 & 2020 \\ \hline Cash \& Equivalents & $178,500 & $132,500 & $101,250 \\ \hline Accounts Receivable & 2,675,000 & 1,850,750 & 1,740,250 \\ \hline Inventory & 875,500 & 642,250 & 572,500 \\ \hline Total Current Assets & 3,729,000 & 2,625,500 & 2,414,000 \\ \hline Prop, Plant \& Equip - Net & 9,245,500 & 8,752,500 & 6,985,000 \\ \hline Total Assets & $12,974,500 & $11,378,000 & $9,399,000 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|r|} \hline & 2022 & 2021 & 2020 \\ \hline Liabilities \& Equity & & & \\ \hline Accounts Payable & $1,250,000 & $983,750 & $645,250 \\ \hline Accrued Wages Payable & 223,500 & 189,700 & 112,400 \\ \hline Income Tax Payable & 175,250 & 152,450 & 195,500 \\ \hline Notes Payable & 403,500 & 375,350 & 322,500 \\ \hline Short-term Bank Loan & 774,750 & 618,750 & 515,350 \\ \hline Total Current Liabilities & 2,827,000 & 2,320,000 & 1,791,000 \\ \hline Long-term Debt & 3,250,500 & 2,807,500 & 1,750,400 \\ \hline Total Liabilities & 6,077,500 & 5,127,500 & 3,541,400 \\ \hline Common Stock & 2,575,500 & 2,325,000 & 2,100,000 \\ \hline Retained Earnings & 4,321,500 & 3,925,500 & 3,757,600 \\ \hline Total Equity & 6,897,000 & 6,250,500 & 5,857,600 \\ \hline Total Liabilities and Equity & $12,974,500 & $11,378,000 & $9,399,000 \\ \hline \end{tabular} Answer the following questions. Please note: short-term investments are non-operating current assets; notes payable and short-term debt are non-operating current liabilities. a) What is the Net Operating Profit after tax (NOPAT) for 2022? b) What is Operating Cash Flow for 2022 ? c) What is Free Cash Flow for 2022? (Notes Payable and Short-term bank loan are not part of operating net working capital.) d) The stock is traded at $66 per share at the end of 2022 and there are 195,000 shares outstanding. What is MVA during 2022 ? e) Given the firm's WACC is 12%, what is EVA during 2022 ? f) Create common size income statement and balance sheet for 2022, 2021 and 2020 . g) Create income statement and balance sheet percentage change analysis for 2022 and 2021. (Use 2020 as the base year) \begin{tabular}{|l|r|r|r|} \hline & \multicolumn{3}{|c|}{ AAA Inc Income Statement } \\ \hline & \multicolumn{3}{|c|}{ For Year Ended Dec 31st} \\ \hline & 2022 & 2021 & 2020 \\ \hline Sales & $19,250,000 & $16,460,000 & $14,140,000 \\ \hline Cost of Goods Sold & 12,640,000 & 11,105,000 & 9,875,000 \\ \hline Selling Expenses & 785,000 & 675,000 & 645,000 \\ \hline Administrative Expenses & 664,000 & 622,000 & 588,000 \\ \hline Advertising Expenses & 523,000 & 475,000 & 390,000 \\ \hline Depreciation & 988,000 & 754,000 & 611,000 \\ \hline Earnings before Interest and Taxes & 3,650,000 & 2,829,000 & 2,031,000 \\ \hline Interest Expense & 275,000 & 203,000 & 197,000 \\ \hline Earnings before Taxes & 3,375,000 & 2,626,000 & 1,834,000 \\ \hline Taxes (28\%) & 945,000 & 735,280 & 513,520 \\ \hline Net Income & $2,430,000 & $1,890,720 & $1,320,480 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|r|} \hline & \multicolumn{3}{|c|}{ AAA Inc Balance Sheet } \\ \hline & \multicolumn{3}{|c|}{ For Year Ended Dec \( 31^{\text {st }}} \), \\ \hline Assets & 2022 & 2021 & 2020 \\ \hline Cash \& Equivalents & $178,500 & $132,500 & $101,250 \\ \hline Accounts Receivable & 2,675,000 & 1,850,750 & 1,740,250 \\ \hline Inventory & 875,500 & 642,250 & 572,500 \\ \hline Total Current Assets & 3,729,000 & 2,625,500 & 2,414,000 \\ \hline Prop, Plant \& Equip - Net & 9,245,500 & 8,752,500 & 6,985,000 \\ \hline Total Assets & $12,974,500 & $11,378,000 & $9,399,000 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|r|} \hline & 2022 & 2021 & 2020 \\ \hline Liabilities \& Equity & & & \\ \hline Accounts Payable & $1,250,000 & $983,750 & $645,250 \\ \hline Accrued Wages Payable & 223,500 & 189,700 & 112,400 \\ \hline Income Tax Payable & 175,250 & 152,450 & 195,500 \\ \hline Notes Payable & 403,500 & 375,350 & 322,500 \\ \hline Short-term Bank Loan & 774,750 & 618,750 & 515,350 \\ \hline Total Current Liabilities & 2,827,000 & 2,320,000 & 1,791,000 \\ \hline Long-term Debt & 3,250,500 & 2,807,500 & 1,750,400 \\ \hline Total Liabilities & 6,077,500 & 5,127,500 & 3,541,400 \\ \hline Common Stock & 2,575,500 & 2,325,000 & 2,100,000 \\ \hline Retained Earnings & 4,321,500 & 3,925,500 & 3,757,600 \\ \hline Total Equity & 6,897,000 & 6,250,500 & 5,857,600 \\ \hline Total Liabilities and Equity & $12,974,500 & $11,378,000 & $9,399,000 \\ \hline \end{tabular} Answer the following questions. Please note: short-term investments are non-operating current assets; notes payable and short-term debt are non-operating current liabilities. a) What is the Net Operating Profit after tax (NOPAT) for 2022? b) What is Operating Cash Flow for 2022 ? c) What is Free Cash Flow for 2022? (Notes Payable and Short-term bank loan are not part of operating net working capital.) d) The stock is traded at $66 per share at the end of 2022 and there are 195,000 shares outstanding. What is MVA during 2022 ? e) Given the firm's WACC is 12%, what is EVA during 2022 ? f) Create common size income statement and balance sheet for 2022, 2021 and 2020 . g) Create income statement and balance sheet percentage change analysis for 2022 and 2021. (Use 2020 as the base year)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts