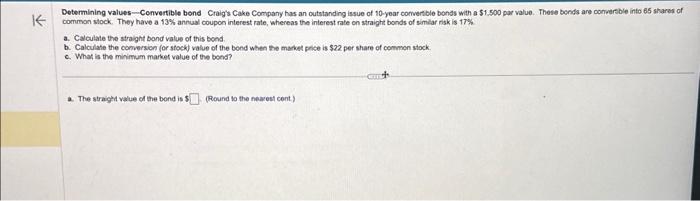

Question: please solve a-c. thanks! Determining values - Convertible bend Craig's Cake Company has an outstanding issue of 10-year comverible bonds with a $1,500 par value.

Determining values - Convertible bend Craig's Cake Company has an outstanding issue of 10-year comverible bonds with a $1,500 par value. These bends are conversble into 65 shares of common stock. They have a 13% annual coupon interest rate, wheneas the interest rate on straight bonds of similar nisk is 17% a. Calculate the straight bond value of this bond b. Calculate the comversion (or stock) value of the bond when the makel phice is $22 per share of common stock. c. What is the minimum market value of the bond? The stracth value of the bond is 5 (Round to the nearest cont)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts