Question: please solve all 16. You are working for a mid-sized company that is booking to estimate its cont of debe. The company has never had

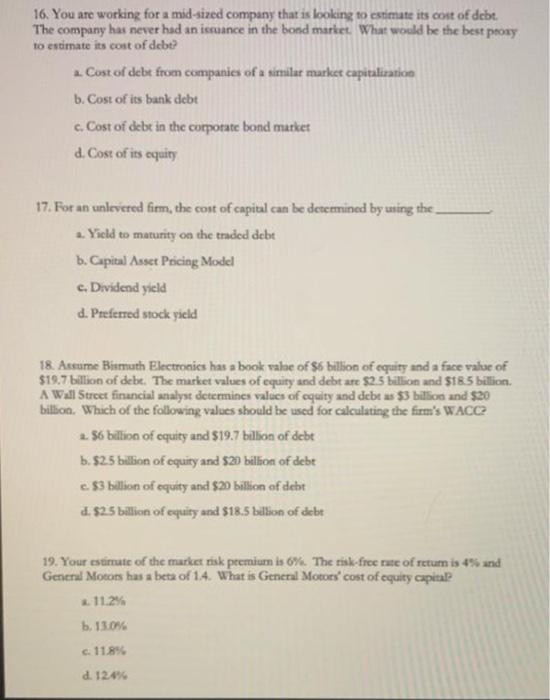

16. You are working for a mid-sized company that is booking to estimate its cont of debe. The company has never had an ismance in the bond mariet. What woold be the best proxy to estimate its cont of dcbt? a. Cost of debe from companies of a similar market capitaliration b. Cost of its bank debt c. Cost of debt in the comporate bond market d. Cost of its cquity 17. For an unlevered firm, the cost of capital can be determined by using the a. Yicld to maturity on the traded debt b. Capital Asset Pricing Model c. Dividend yield d. Preferred stock yield 18. Assume Bismuth Electronies has a book valee of $5 billion of equity and a face value of $19.7 billion of debe. The market values of equity and debt are $2.5 billion and $18.5 billion. A Wall Street financial analyst determines valees of equity and debe as $3 bithoo and $20 billion. Which of the following values should be used for calculating the firm's WACC? 2. 56 biltion of equity and $19.7 bilison of debt b. $2.5 billion of equiry and $20 billion of debt c. $3 bellion of equity and $20 billion of debt d. $2.5 billion of equity and $18.5 billion of debe 19. Your estimute of the market nisk peemium is 6%. The risk-free rate of retum is 4% and General Moeors has a beta of 1.4. What is General Motors' cost of equity capitale a. 11.2% b. 1300N c. 11.8% d. 124%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts