Question: please solve all 4 pleaseee Excel Online Structured Activity: ROE and ROIC Baker Industries net income is $24000, its interest expense is $4000, and its

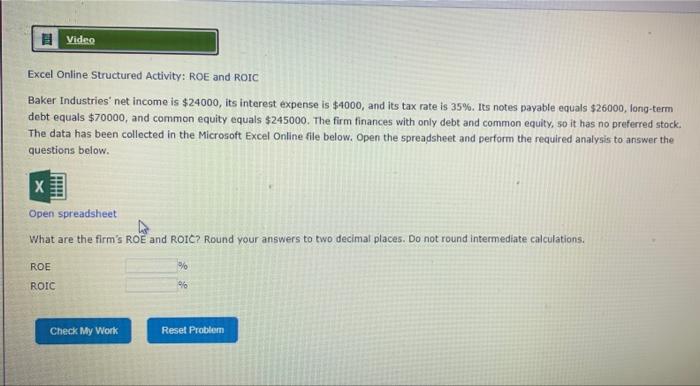

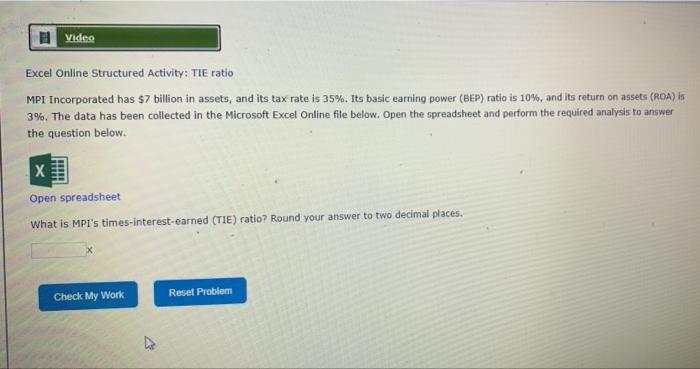

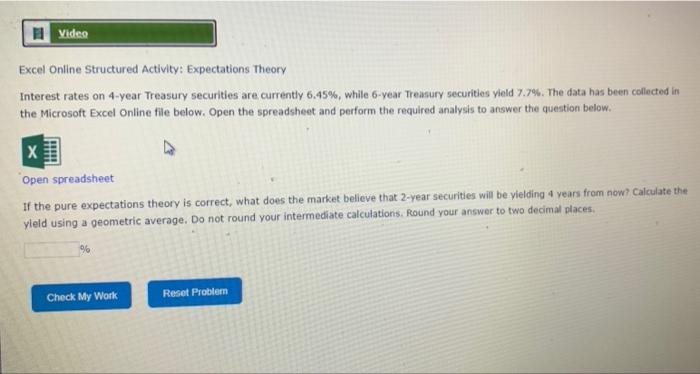

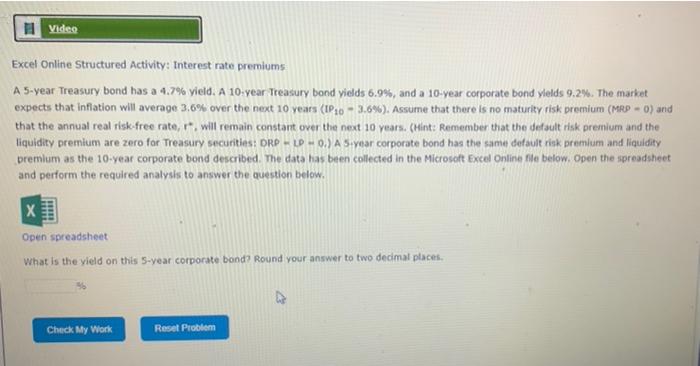

Excel Online Structured Activity: ROE and ROIC Baker Industries" net income is $24000, its interest expense is $4000, and its tax rate is 35%. Its notes payable equals $26000, long-term debt equals $70000, and common equity equals $245000. The firm finances with only debt and common equity, 50 it has no preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Excel Online Structured Activity: TIE ratio MPI Incorporated has $7 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 10%, and its return on assets (R0A) is 3%. The data has been collected in the Microsoft Excel Online file below, Open the spreadsheet and perform the required analysis to answer the question below. Excel Online Structured Activity: Expectations Theory Interest rates on 4-year Treasury securities are currently 6.45%, while 6-year Treasury securities yield 7.7\%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet If the pure expectations theory is correct, what does the market believe that 2 -year securities will be yielding 4 years from now? Calculate the yleld using a geometric average. Do not round your intermediate calculations. Round your answer to two decimal piaces. A 5-year Treasury bond has a 4.7\% yield. A 10.year. Treasury bond yields 6.9%, and a 10-year corporate bond ylelds 9.2%. The market expects that infiation will average 3.6% over the next 10 years (1P10=3.6% ). Assume that there is no maturity risk premium (MRP =0 ) and that the annual real risk-free rate, r, will remain constart over the next 10 years. (Hint: Remember that the default risk premium and the liquidity premlum are zero for Treasury securities: DRP - LD = 0.) A 5 .year corporate bond has the same default risk premium and liquidity bremlum as the 10-year corporate bond described. The data has been collected in the Microsoft Excel Online fife below. Open the spreadsheet and perform the required analysis to answer the questlon below. Open spreadsheet What is the yield on this 5 -year corporate bond? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts