Question: PLEASE SOLVE ALL 4 QUESTIONS DO NOT WASTE TIME IN EXPLAINING OR SOLVING! Question 35 (1 point On March 31, 2021, Sergio received $3,600 cash

PLEASE SOLVE ALL 4 QUESTIONS

DO NOT WASTE TIME IN EXPLAINING OR SOLVING!

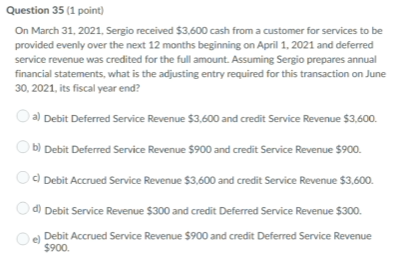

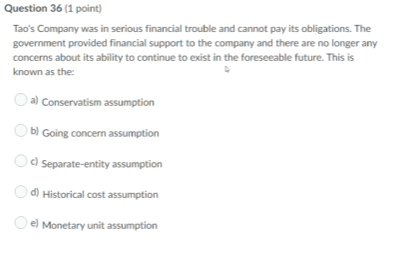

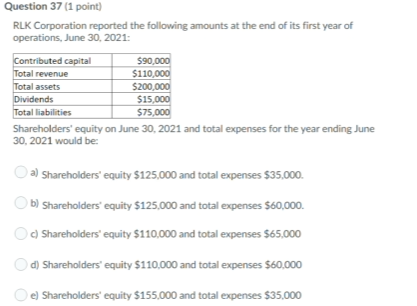

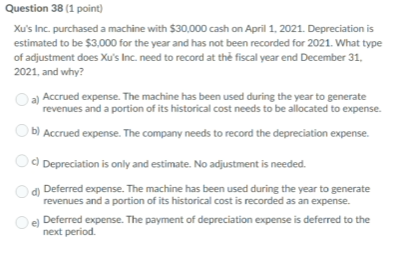

Question 35 (1 point On March 31, 2021, Sergio received $3,600 cash from a customer for services to be provided evenly over the next 12 months beginning on April 1, 2021 and deferred service revenue was credited for the full amount. Assuming Sergio prepares annual financial statements, what is the adjusting entry required for this transaction on June 30, 2021, its fiscal year end? a) Debit Deferred Service Revenue $3,600 and credit Service Revenue $3,600. b) Debit Deferred Service Revenue $900 and credit Service Revenue $900. c) Debit Accrued Service Revenue $3,600 and credit Service Revenue $3,600. d) Debit Service Revenue $300 and credit Deferred Service Revenue $300. Debit Accrued Service Revenue $900 and credit Deferred Service Revenue el $900. Question 36 (1 point) Tao's Company was in serious financial trouble and cannot pay its obligations. The government provided financial support to the company and there are no longer any concerns about its ability to continue to exist in the foreseeable future. This is known as the a) Conservatism assumption b) Going concern assumption Separate-entity assumption d) Historical cost assumption el Monetary unit assumption Question 37 (1 point) RLK Corporation reported the following amounts at the end of its first year of operations, June 30, 2021: Contributed capital $90,000 Total revenue $110,000 Total assets $200,000 Dividends $15,000 Total liabilities $75,000 Shareholders' equity on June 30, 2021 and total expenses for the year ending June 30, 2021 would be: a) Shareholders' equity $125,000 and total expenses $35,000 b) Shareholders' equity $125,000 and total expenses $60,000. c) Shareholders' equity $110,000 and total expenses $65,000 d) Shareholders' equity $110,000 and total expenses $60,000 e) Shareholders' equity $155,000 and total expenses $35,000 Question 38 (1 point) Xu's Inc. purchased a machine with $30,000 cash on April 1, 2021. Depreciation is estimated to be $3,000 for the year and has not been recorded for 2021. What type of adjustment does Xu's Inc. need to record at the fiscal year end December 31, 2021, and why? Accrued expense. The machine has been used during the year to generate revenues and a portion of its historical cost needs to be allocated to expense. b) Accrued expense. The company needs to record the depreciation expense. Depreciation is only and estimate. No adjustment is needed. Deferred expense. The machine has been used during the year to generate revenues and a portion of its historical cost is recorded as an expense. Deferred expense. The payment of depreciation expense is deferred to the next period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts