Question: please solve all CASE 1: John Davidson started her practice as a registered interior designer on February 3 of the current year. During the first

please solve all

please solve all

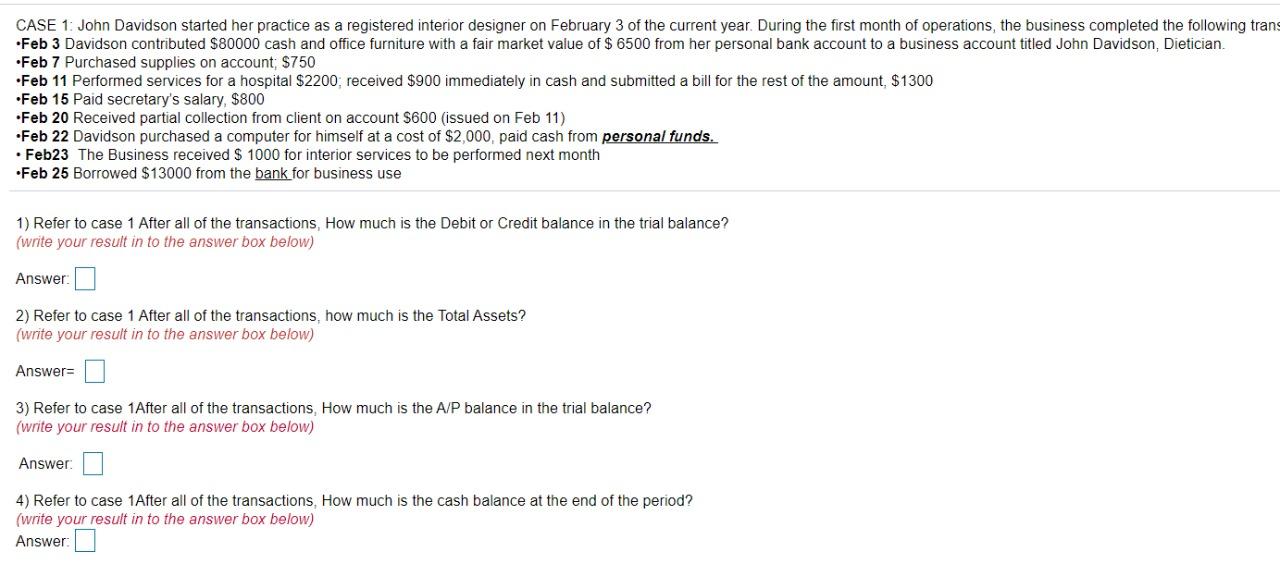

CASE 1: John Davidson started her practice as a registered interior designer on February 3 of the current year. During the first month of operations, the business completed the following trans Feb 3 Davidson contributed $80000 cash and office furniture with a fair market value of $ 6500 from her personal bank account to a business account titled John Davidson, Dietician. Feb 7 Purchased supplies on account: $750 Feb 11 Performed services for a hospital $2200, received $900 immediately in cash and submitted a bill for the rest of the amount, $1300 Feb 15 Paid secretary's salary, $800 Feb 20 Received partial collection from client on account $600 (issued on Feb 11) Feb 22 Davidson purchased a computer for himself at a cost of $2,000, paid cash from personal funds. Feb23 The Business received $ 1000 for interior services to be performed next month Feb 25 Borrowed $13000 from the bank for business use 1) Refer to case 1 After all of the transactions, How much is the Debit or Credit balance in the trial balance? (write your result in to the answer box below) Answer: 2) Refer to case 1 After all of the transactions, how much is the Total Assets? (write your result in to the answer box below) Answer=0 3) Refer to case 1After all of the transactions, How much is the A/P balance in the trial balance? (write your result in to the answer box below) Answer: 0 4) Refer to case 1After all of the transactions, How much is the cash balance at the end of the period? (write your result in to the answer box below)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts