Question: please solve all part asap thanks Return to question The Mahela Company specializes in producing sets of wooden patio furniture consisting of a table and

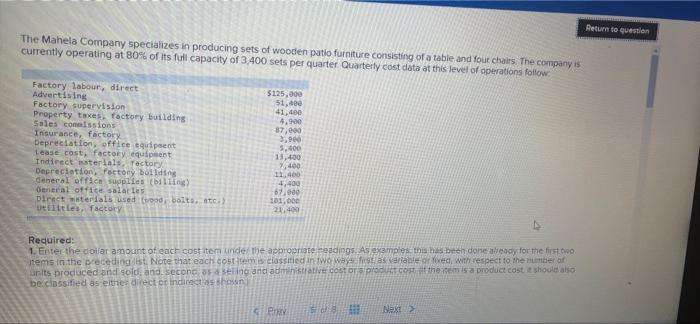

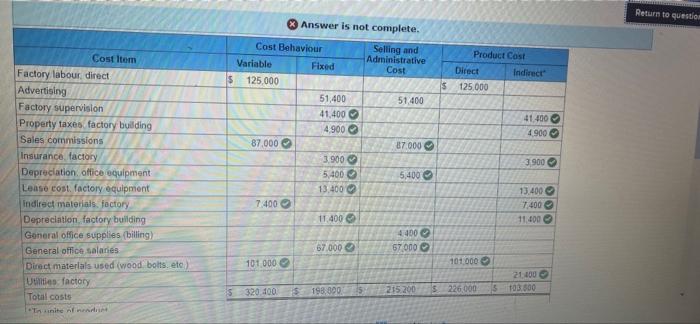

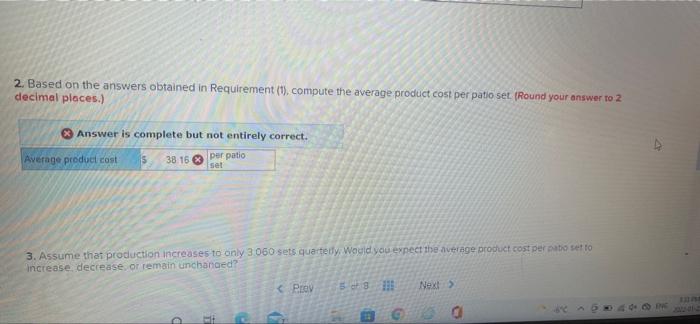

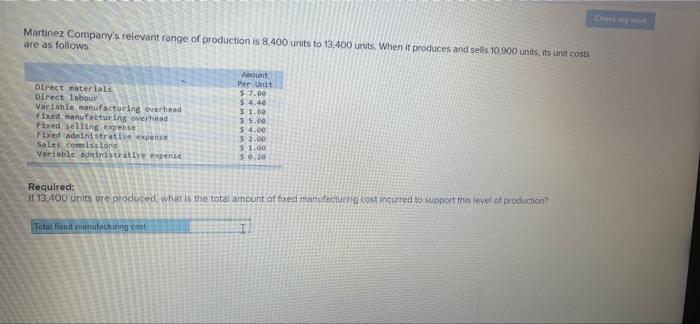

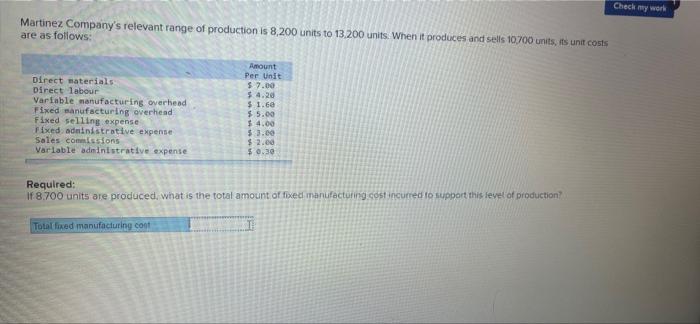

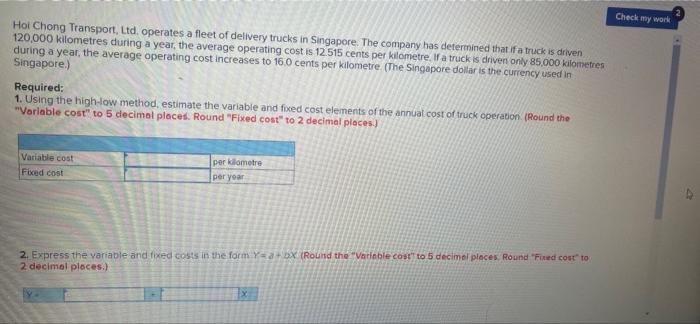

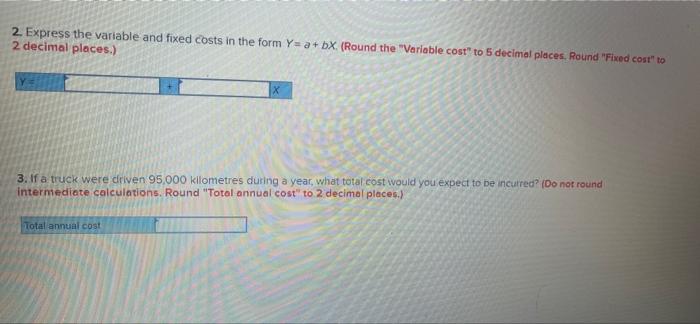

Return to question The Mahela Company specializes in producing sets of wooden patio furniture consisting of a table and four chairs. The company is currently operating at 80% of its full capacity of 3.400 sets per quarter Quarterly cost data at this level of operations follow Factory labour, direct Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation office equipent Lease cost, factory equipment Indirect materials, factory Depreciation. Foctory building deneral office supplies ling) General office salarles Direct materials used bolts. Atc.) Utilities, factory $125,000 51.000 41,400 4,900 37,000 3,00 5.400 13,400 7,400 11.400 4,400 07.000 101, 21.400 Required: 1. Enter the collar amount of each cost item under the appropriate readings. As examples that has been done already for the first two items in the precedingt. Note that each cost items classified in two ways tas variable or ied, with respect to the number of units produced and sold, and second ass and administrative costor product cost it them is a product cast it should also be classified as either director incitec shown GP Next Return to question Answer is not complete. Selling and Administrative Cost Product Cast Direct Indirect 125,000 $ $ 51400 Cost Behaviour Variable Fixed 125.000 51,400 41,400 4900 87,000 3.900 5,400 13,400 7.400 11.400 41.400 4900 87.000 3.900 Cost Item Factory labour direct Advertising Factory supervision Property taxes factory building Sales commissions Insurance, factory Depreciation office equipment Lease cost, factory equipment Indirect materials factory Depreciation factory building General office supplies (billing) General office salaries Direct materials used (wood bolts, etc) Utilities factory Total costo In inte 5,400 13.400 7.400 11.000 4400 67.000 67.000 101.000 101000 2100 103.600 15 5320 100$198.000 215.200 5 $226,000 2. Based on the answers obtained in Requirement (1), compute the average product cost per patio set (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Average product cost is 38.15 per patio set 3. Assume that production increases to only 3 060 sets quartetty. Would you expect the average product cost percato set to Increase decrease or remain unchanged? Prev Next > Martinez Company's relevant range of production is 8.400 units to 13,400 units. When it produces and sells 10.900 units, its unit costs are as follows Direct materials Direct labour Valoble manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales comissions Variable administrative expense About Per Unit $7.00 $ 4.40 $1.00 5.5.00 $14.00 5.2.00 51.00 5.0.0 Required: If 13.400 units are produced, what is the total amount of fixed manufactura cont incurred to support this level of production Totalfixed manufacturing con 1 Check my work Martinez Company's relevant range of production is 8,200 units to 13.200 units. When it produces and sells 10700 units, its unit costs are as follows: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Amount Per Unit $ 7.00 5.4.20 $ 1.60 $ 5.00 $ 4.00 $ 3.00 $ 2.00 $ 0.30 Required: If 8.700 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production? Total fixed manufacturing cont Check my work Hoi Chong Transport, Ltd. operates a fleet of delivery trucks in Singapore. The company has determined that if a truck is driven 120,000 kilometres during a year, the average operating cost is 12.515 cents per kilometre. If a truck is driven only 85,000 kilometres during a year, the average operating cost increases to 160 cents per kilometre (The Singapore dollar is the currency used in Singapore.) Required: 1. Using the high-low method, estimate the variable and fixed cost elements of the annual cost of truck operation (Round the "Variable cost" to 5 decimal places. Round "Fixed cost" to 2 decimal places.) Variable cost Fixed cost per kilometre per year 2. Express the variable and fixed costs in the form yox (Round the "Variable cost to 5 decimal places. Round "Fixed cost to 2 decimal places.) 1x 2. Express the variable and fixed costs in the form Y=a+bX (Round the "Variable cost" to 5 decimal places. Round "Fixed cost" to 2 decimal places.) 3. If a truck were driven 95.000 kilometres during a year, what total cost would you expect to be incurred? (Do not round intermediate calculations. Round "Total annual cost" to 2 decimal places.) Total annual cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts