Question: Please solve all parts by hand: 2. Bow Technology, Inc. (BTI) has total assets of $20 million. If BTI finances 25 percent of its total

Please solve all parts by hand:

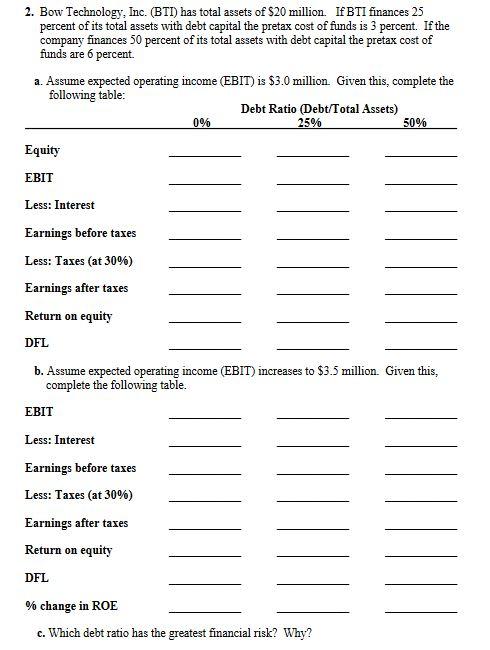

2. Bow Technology, Inc. (BTI) has total assets of $20 million. If BTI finances 25 percent of its total assets with debt capital the pretax cost of funds is 3 percent. If the company finances 50 percent of its total assets with debt capital the pretax cost of funds are 6 percent. a. Assume expected operating income (EBIT) is $3.0 million Given this complete the following table: Debt Ratio (Debt/Total Assets) 0% 25% 50% Equity EBIT Less: Interest Earnings before taxes Less: Taxes (at 30%) Earnings after taxes Return on equity DFL b. Assume expected operating income (EBIT) increases to $3.5 million. Given this, complete the following table. EBIT Less: Interest Earnings before taxes Less: Taxes (at 30%) Earnings after taxes Return on equity DFL % change in ROE c. Which debt ratio has the greatest financial risk? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts