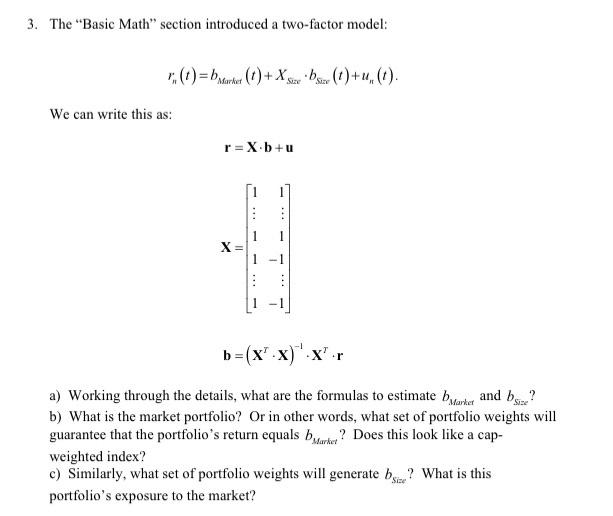

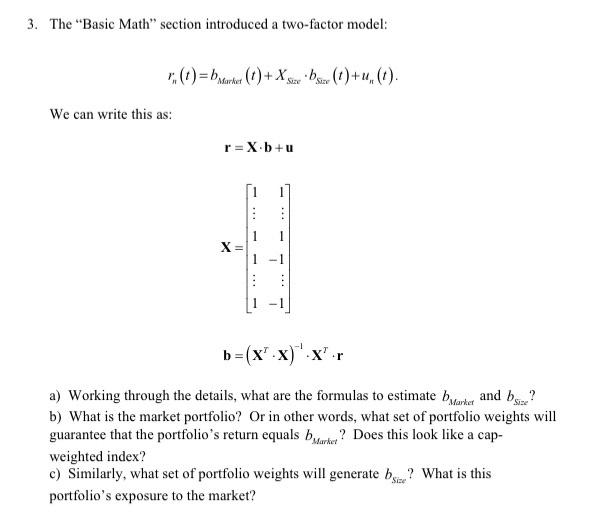

Question: Please solve all parts completely: 3. The Basic Math section introduced a two-factor model: (t)=barker (t) + Xboxe (1)+ (). We can write this as:

3. The "Basic Math" section introduced a two-factor model: (t)=barker (t) + Xboxe (1)+ (). We can write this as: r=X.b+u X= 1 -- 1 IR - b =(xx)"x"r a) Working through the details, what are the formulas to estimate baranker and baie? b) What is the market portfolio? Or in other words, what set of portfolio weights will guarantee that the portfolio's return equals barter? Does this look like a cap- weighted index? c) Similarly, what set of portfolio weights will generate bu? What is this portfolio's exposure to the market? 3. The "Basic Math" section introduced a two-factor model: (t)=barker (t) + Xboxe (1)+ (). We can write this as: r=X.b+u X= 1 -- 1 IR - b =(xx)"x"r a) Working through the details, what are the formulas to estimate baranker and baie? b) What is the market portfolio? Or in other words, what set of portfolio weights will guarantee that the portfolio's return equals barter? Does this look like a cap- weighted index? c) Similarly, what set of portfolio weights will generate bu? What is this portfolio's exposure to the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts