Question: Please solve all problem and provide contexts losses can be deducted on her final income tax return. estion 2 0 out of 1 points maximum

Please solve all problem and provide contexts

Please solve all problem and provide contexts

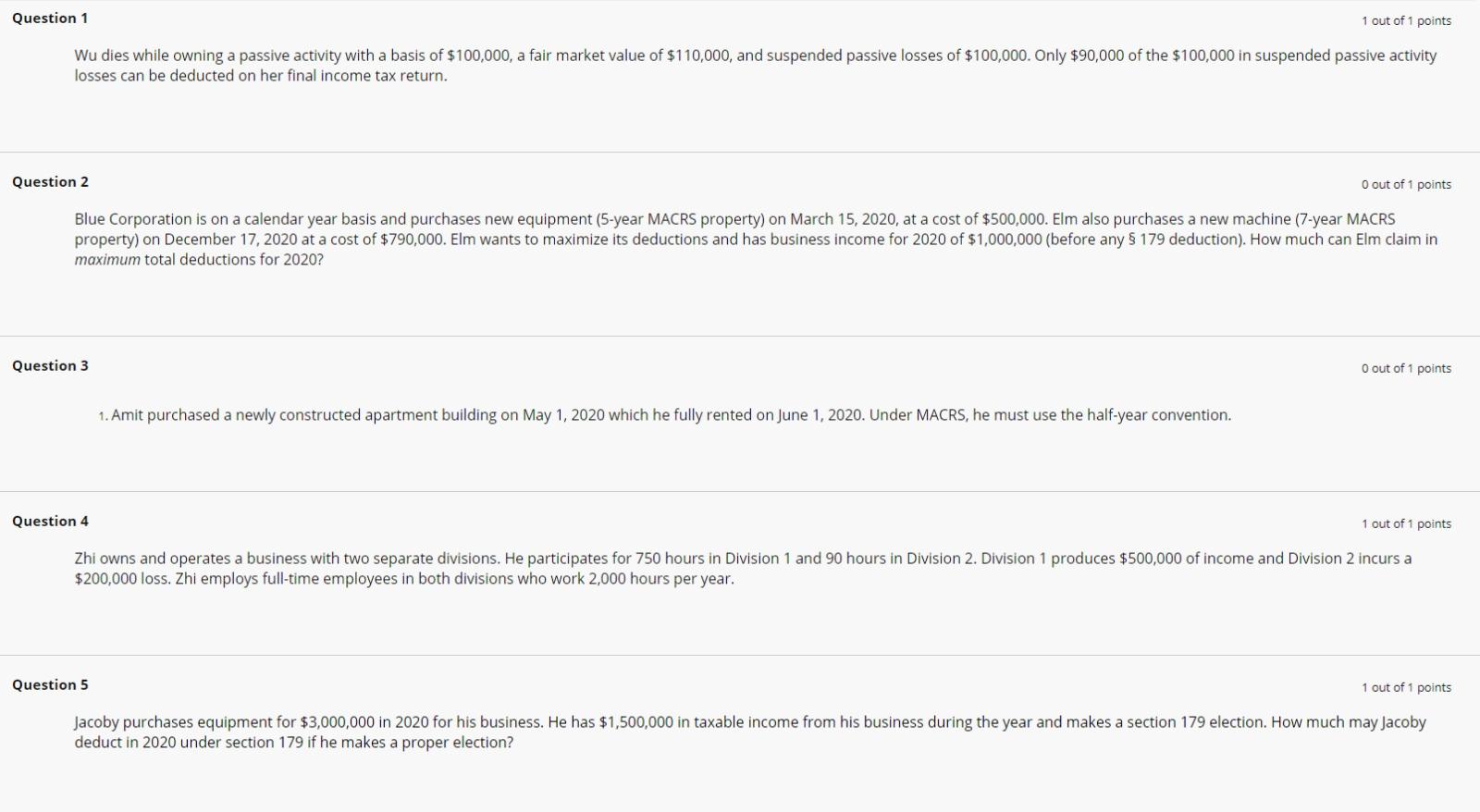

losses can be deducted on her final income tax return. estion 2 0 out of 1 points maximum total deductions for 2020 ? 1. Amit purchased a newly constructed apartment building on May 1, 2020 which he fully rented on June 1, 2020 . Under MACRS, he must use the half-year convention. estion 4 1 out of 1 points $200,000 loss. Zhi employs full-time employees in both divisions who work 2,000 hours per year. estion 5 1 out of 1 points deduct in 2020 under section 179 if he makes a proper election? losses can be deducted on her final income tax return. estion 2 0 out of 1 points maximum total deductions for 2020 ? 1. Amit purchased a newly constructed apartment building on May 1, 2020 which he fully rented on June 1, 2020 . Under MACRS, he must use the half-year convention. estion 4 1 out of 1 points $200,000 loss. Zhi employs full-time employees in both divisions who work 2,000 hours per year. estion 5 1 out of 1 points deduct in 2020 under section 179 if he makes a proper election

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts