Question: Please solve all questions with full solution and explanation 1. (a) Company D gives an offer to buy Company E for 120 million at any

Please solve all questions with full solution and explanation

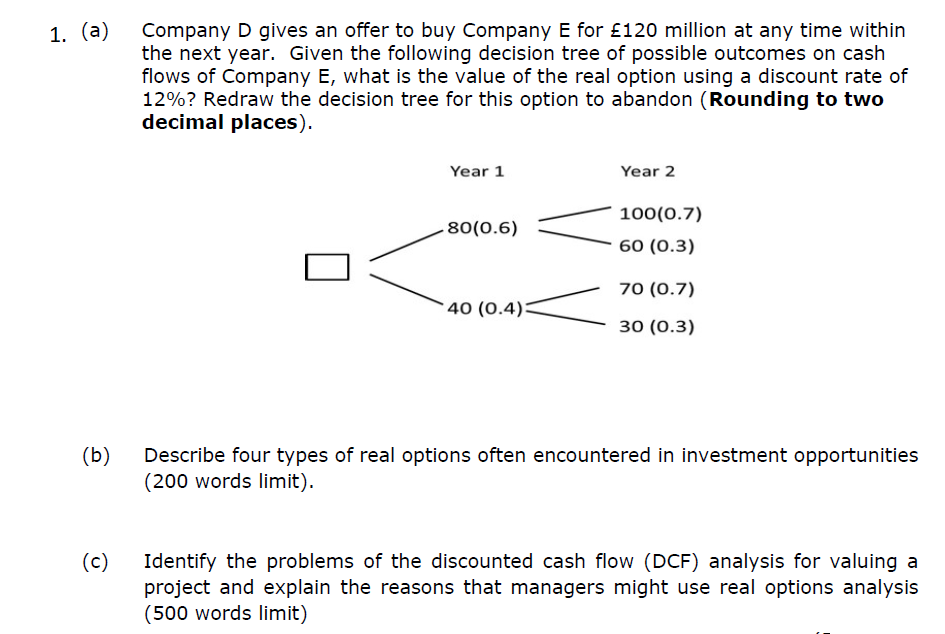

1. (a) Company D gives an offer to buy Company E for 120 million at any time within the next year. Given the following decision tree of possible outcomes on cash flows of Company E, what is the value of the real option using a discount rate of 12%? Redraw the decision tree for this option to abandon (Rounding to two decimal places). Year 1 Year 2 80(0.6) 100(0.7) 60 (0.3) 70 (0.7) 40 (0.4) 30 (0.3) (b) Describe four types of real options often encountered in investment opportunities (200 words limit). (c) Identify the problems of the discounted cash flow (DCF) analysis for valuing a project and explain the reasons that managers might use real options analysis (500 words limit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts