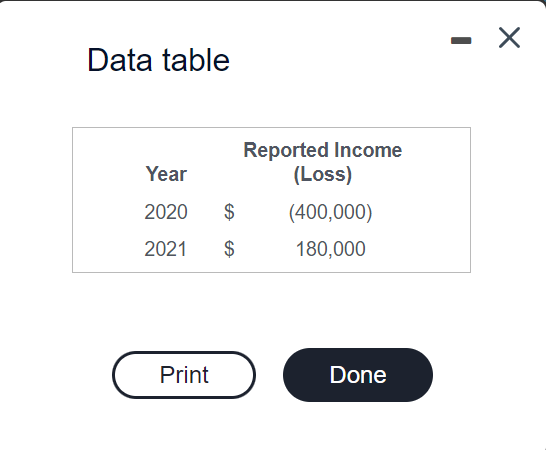

Question: Please solve all requirements :) Data table Jay Holiday Incorporated provides you with the following information. (Click the icon to view the information.) The company

Please solve all requirements :)

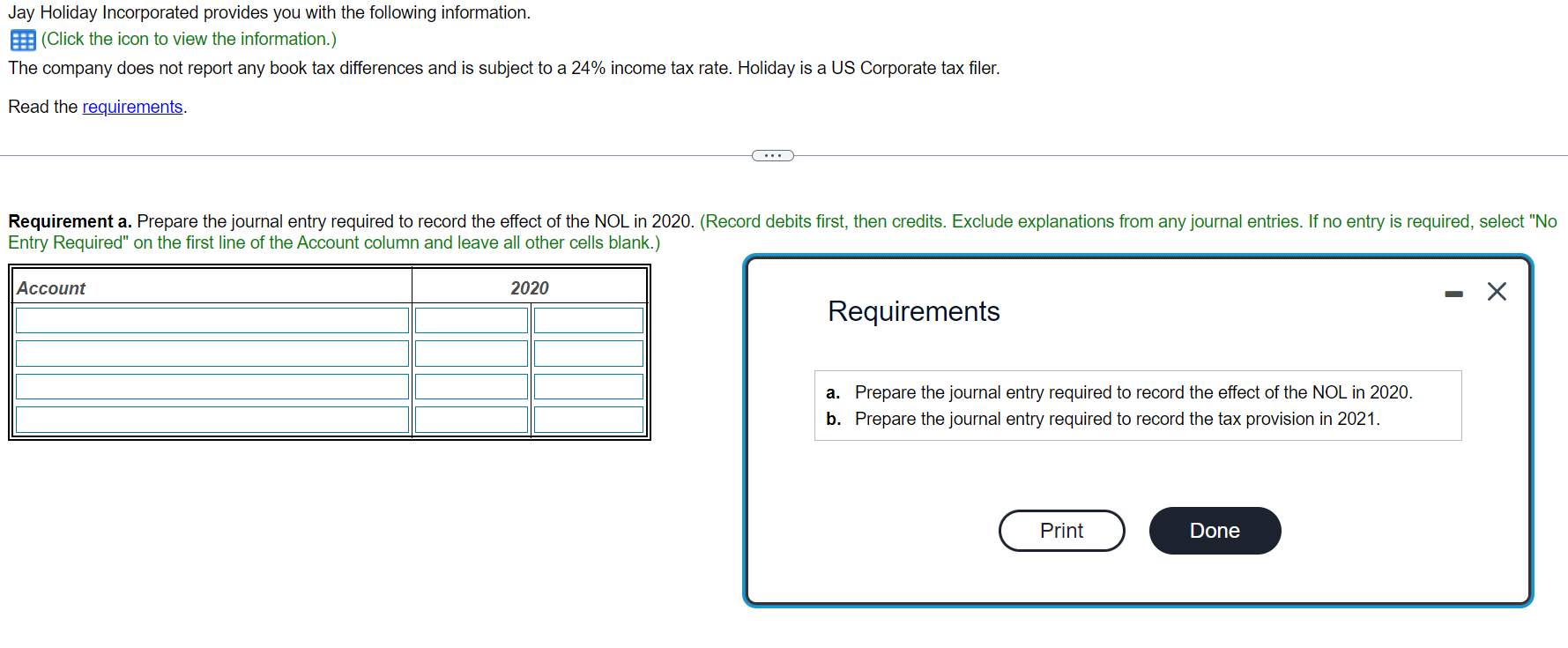

Data table Jay Holiday Incorporated provides you with the following information. (Click the icon to view the information.) The company does not report any book tax differences and is subject to a 24% income tax rate. Holiday is a US Corporate tax filer. Read the requirements. Requirement a. Prepare the journal entry required to record the effect of the NOL in 2020. (Record debits first, then credits. Exclude exp Entry Required" on the first line of the Account column and leave all other cells blank.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts