Question: please, solve all sections correctly and completely On April 30, 2023, Pike Company paid $5,800,000 to acquire all of the common stock of Star Corporation,

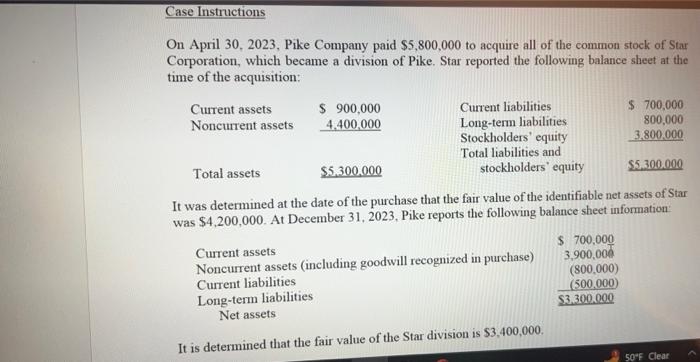

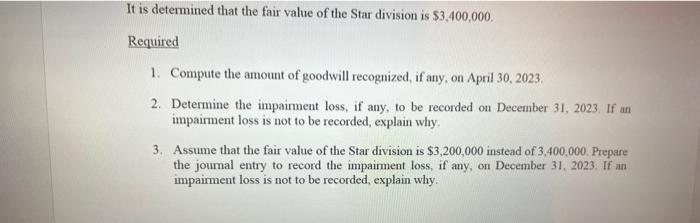

On April 30, 2023, Pike Company paid $5,800,000 to acquire all of the common stock of Star Corporation, which became a division of Pike. Star reported the following balance sheet at the time of the acquisition: It was determined at the date of the purchase that the fair value of the identifiable net assets of Star was $4,200,000. At December 31, 2023. Pike reports the following balance sheet information: It is determined that the fair value of the Star division is $3,400,000. It is determined that the fair value of the Star division is $3,400,000. Required 1. Compute the amount of goodwill recognized, if any, on April 30,2023. 2. Determine the impairment loss, if any, to be recorded on December 31,2023 . If an impairment loss is not to be recorded, explain why. 3. Assume that the fair value of the Star division is $3,200,000 instead of 3,400,000. Prepare the joumal entry to record the impairment loss, if any, on December 31,2023, If an impairment loss is not to be recorded, explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts