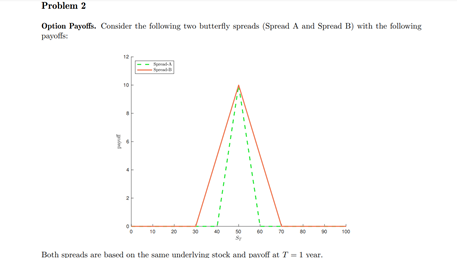

Question: Please solve all subparts. Problem 2 Option Payoffs. Consider the following two butterfly spreads (Spread A and Spread B) with the following payoffs 10 1

Please solve all subparts.

Please solve all subparts.

Problem 2 Option Payoffs. Consider the following two butterfly spreads (Spread A and Spread B) with the following payoffs 10 1 2 Both spreads are based on the same underlying stock and off at T (n) (5 points) Find portfolios using calls, puts, stocks, and/or bonds to replicate the payoffs of Spread A and Spread B. Solution: (b) (5 points) On the graph below, draw the payoff when you go long Band short spread A. Do not include the upfront premiums, only the terminal payoffs at T = 2. 8 100 (c) (5 points) Suppose that the price of spread B is lower than the price of spread A. Explain how you can construct an arbitrage. Solution: Problem 2 Option Payoffs. Consider the following two butterfly spreads (Spread A and Spread B) with the following payoffs 10 1 2 Both spreads are based on the same underlying stock and off at T (n) (5 points) Find portfolios using calls, puts, stocks, and/or bonds to replicate the payoffs of Spread A and Spread B. Solution: (b) (5 points) On the graph below, draw the payoff when you go long Band short spread A. Do not include the upfront premiums, only the terminal payoffs at T = 2. 8 100 (c) (5 points) Suppose that the price of spread B is lower than the price of spread A. Explain how you can construct an arbitrage. Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts