Question: Please solve all the parts and empty boxes. Determining and evaluating project cash flows for a home solar system You are keen on the use

Please solve all the parts and empty boxes.

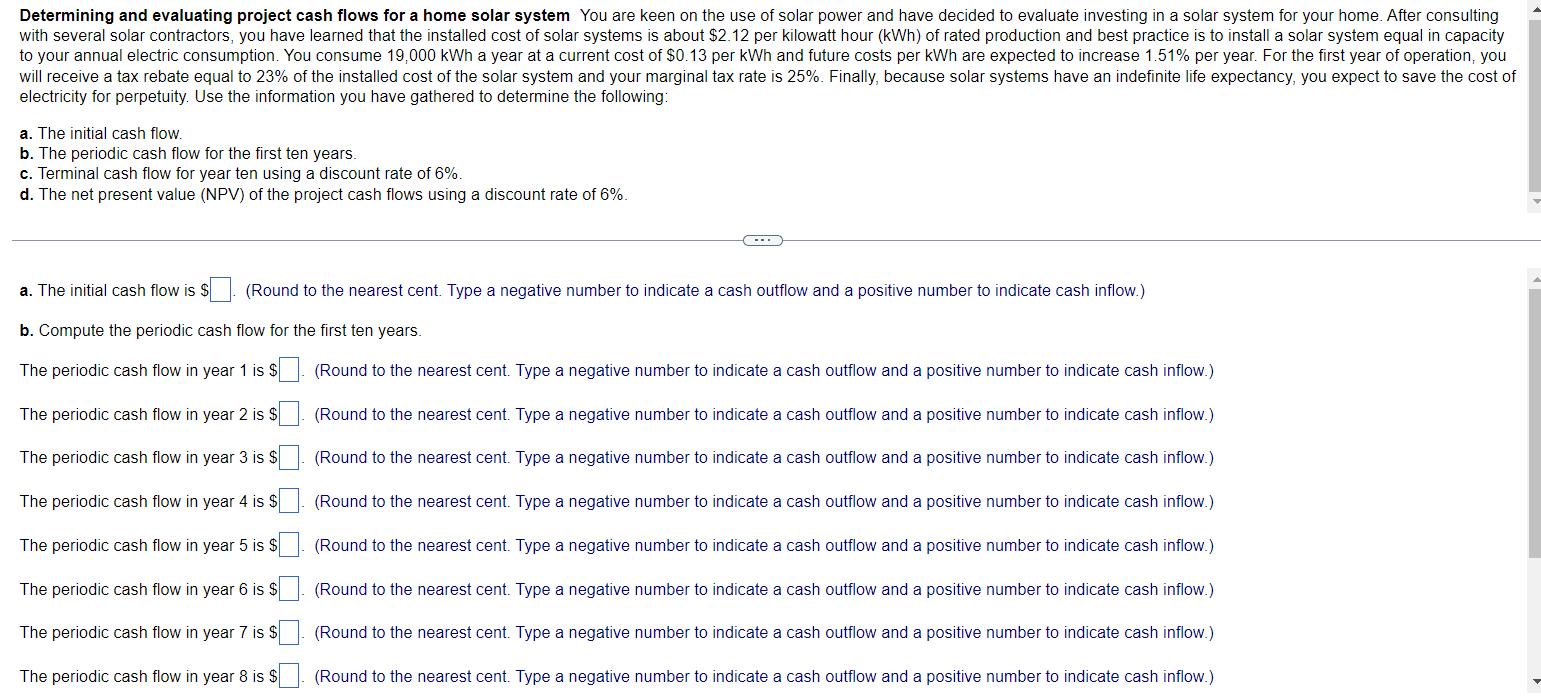

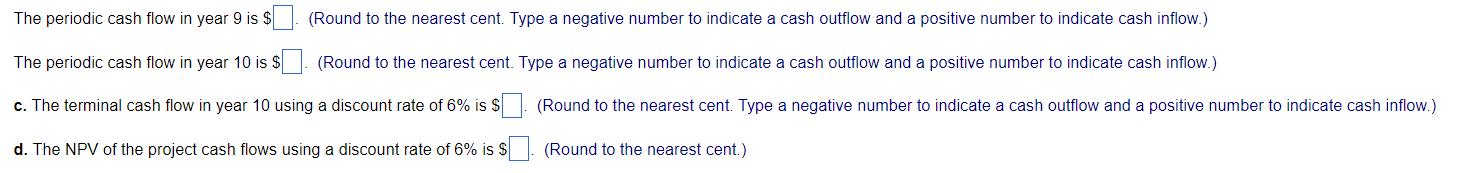

Determining and evaluating project cash flows for a home solar system You are keen on the use of solar power and have decided to evaluate investing in a solar system for your home. After consulting with several solar contractors, you have learned that the installed cost of solar systems is about $2.12 per kilowatt hour (kWh) of rated production and best practice is to install a solar system equal in capacity to your annual electric consumption. You consume 19,000 kWh a year at a current cost of $0.13 per kWh and future costs per kWh are expected to increase 1.51% per year. For the first year of operation, you will receive a tax rebate equal to 23% of the installed cost of the solar system and your marginal tax rate is 25%. Finally, because solar systems have an indefinite life expectancy, you expect to save the cost of electricity for perpetuity. Use the information you have gathered to determine the following: a. The initial cash flow. b. The periodic cash flow for the first ten years. c. Terminal cash flow for year ten using a discount rate of 6%. d. The net present value (NPV) of the project cash flows using a discount rate of 6%. a. The initial cash flow is $ (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.) (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.) (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.) (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.) (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.) (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.) (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.) (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.) b. Compute the periodic cash flow for the first ten years. The periodic cash flow in year 1 is $ The periodic cash flow in year 2 is $ The periodic cash flow in year 3 is $ The periodic cash flow in year 4 is $ The periodic cash flow in year 5 is $ The periodic cash flow in year 6 is $ The periodic cash flow in year 7 is $ The periodic cash flow in year 8 is $ (Round to the nearest cent. Type a negative number to indicate a cash outflow and a positive number to indicate cash inflow.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts