Question: Please solve all the problems here: The Gilbert Building is a two story, 55,000 square foot office building with 50,000 sq. ft. of rentable space.

Please solve all the problems here:

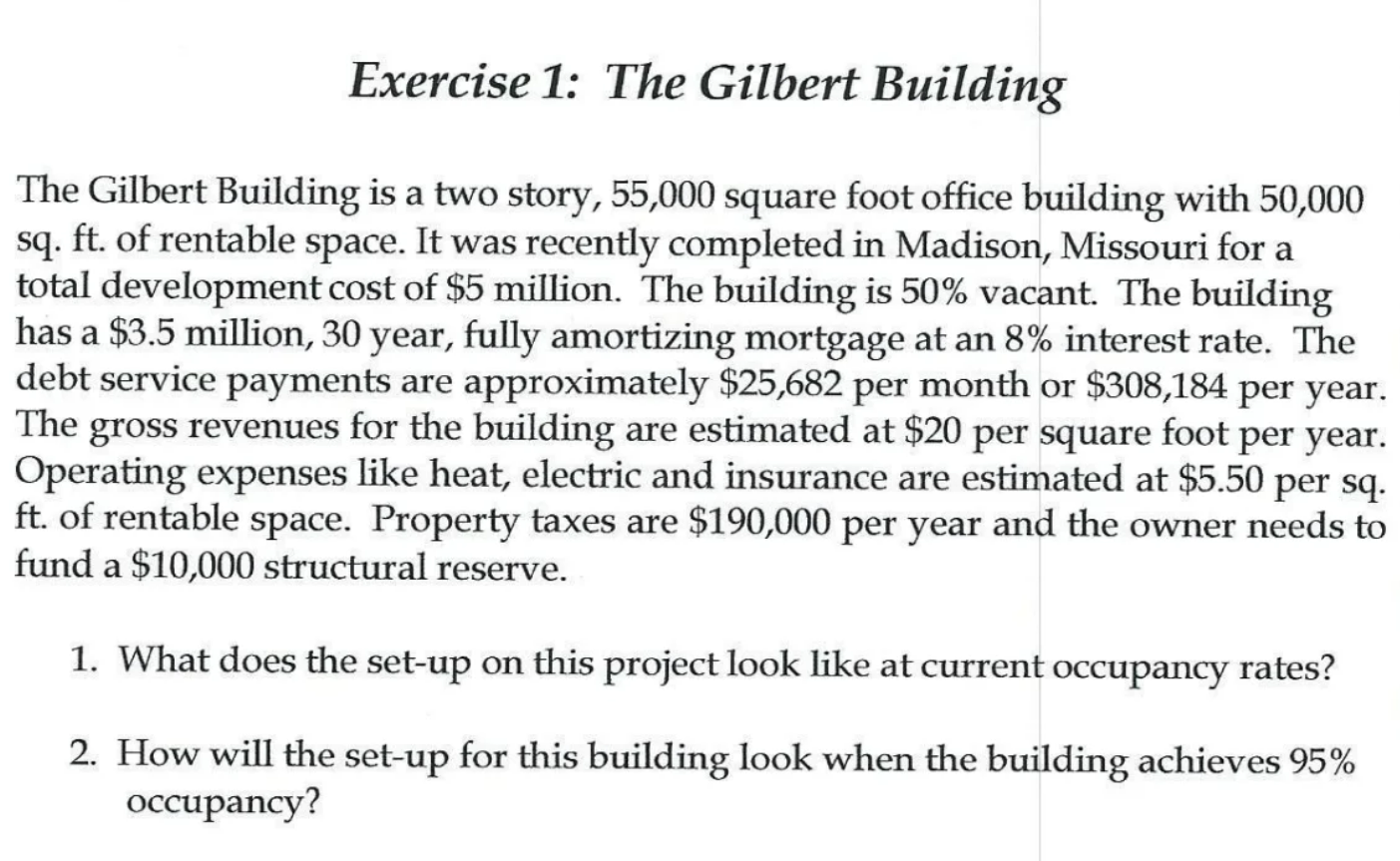

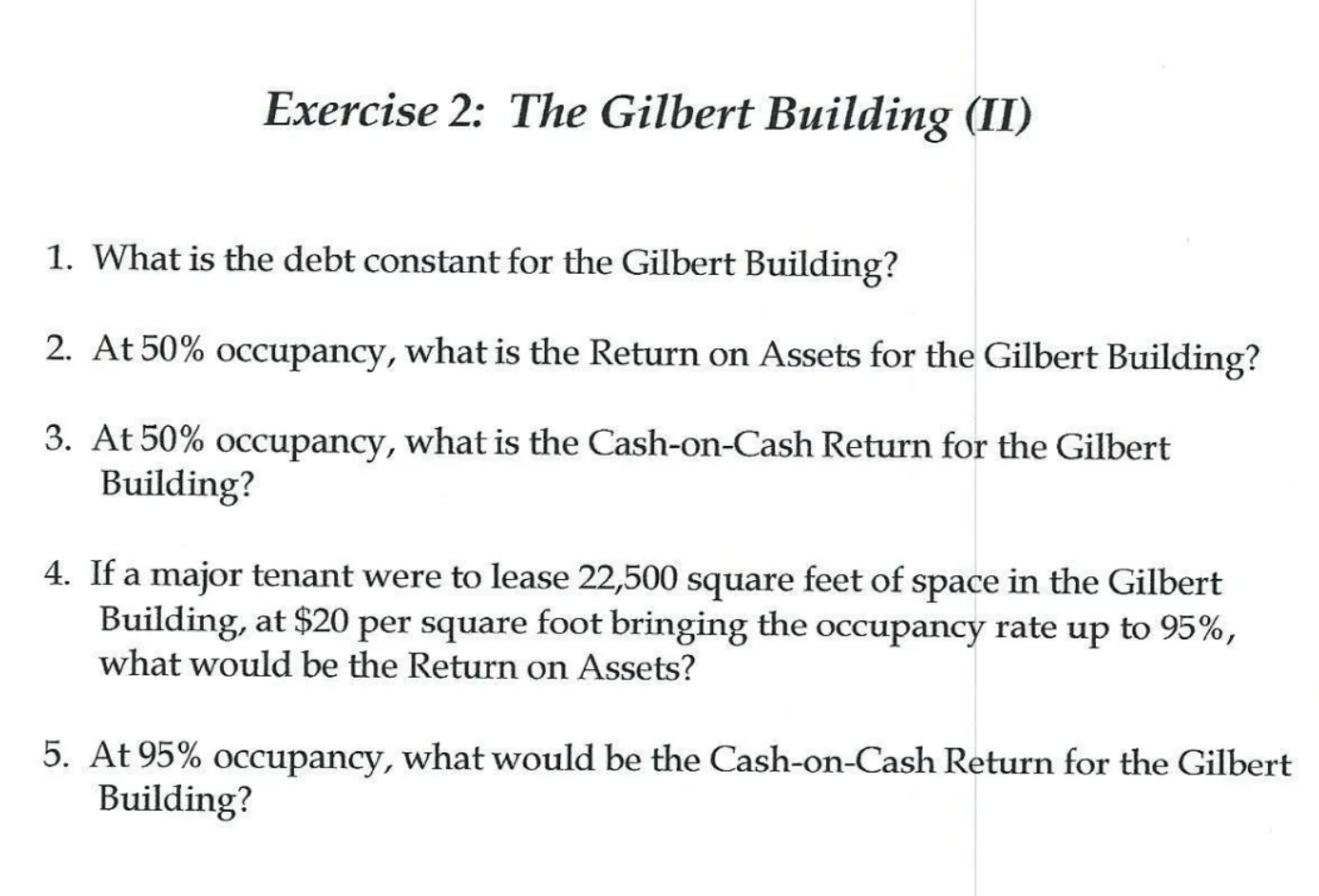

The Gilbert Building is a two story, 55,000 square foot office building with 50,000 sq. ft. of rentable space. It was recently completed in Madison, Missouri for a total development cost of $5 million. The building is 50% vacant. The building has a $3.5 million, 30 year, fully amortizing mortgage at an 8% interest rate. The debt service payments are approximately $25,682 per month or $308,184 per year. The gross revenues for the building are estimated at $20 per square foot per year. Operating expenses like heat, electric and insurance are estimated at $5.50 per sq. ft. of rentable space. Property taxes are $190,000 per year and the owner needs to fund a $10,000 structural reserve. 1. What does the set-up on this project look like at current occupancy rates? 2. How will the set-up for this building look when the building achieves 95% occupancy? Exercise 2: The Gilbert Building (II) 1. What is the debt constant for the Gilbert Building? 2. At 50% occupancy, what is the Return on Assets for the Gilbert Building? 3. At 50% occupancy, what is the Cash-on-Cash Return for the Gilbert Building? 4. If a major tenant were to lease 22,500 square feet of space in the Gilbert Building, at $20 per square foot bringing the occupancy rate up to 95%, what would be the Return on Assets? 5. At 95% occupancy, what would be the Cash-on-Cash Return for the Gilbert Building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts