Question: A competitive lender makes loans to a pool of borrowers that are identical. After borrowers have received their loans they choose one of two

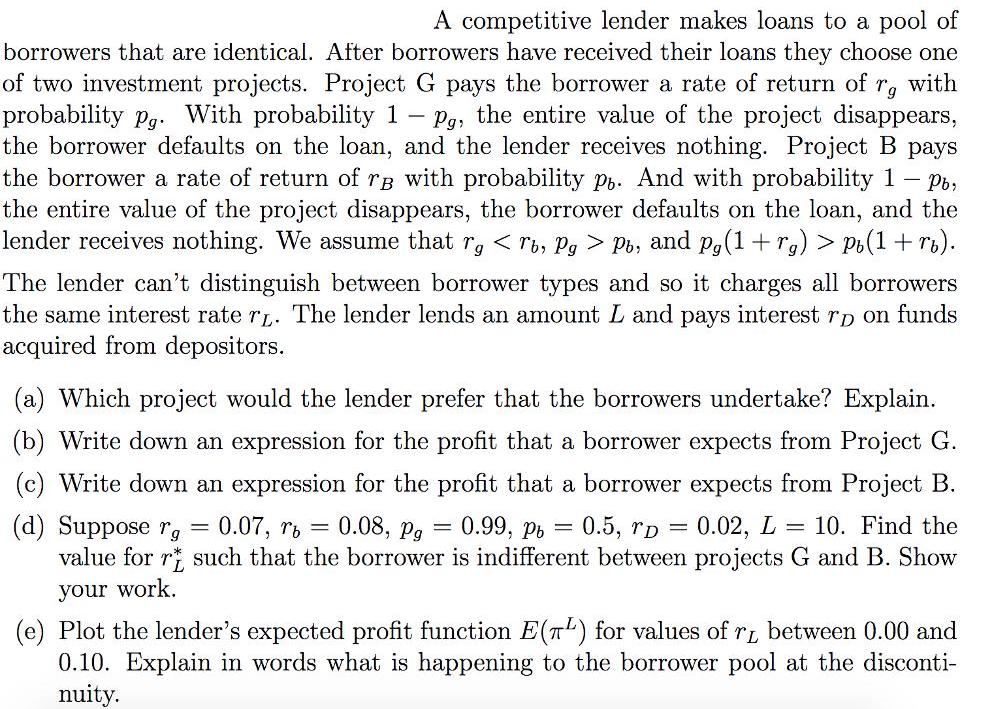

A competitive lender makes loans to a pool of borrowers that are identical. After borrowers have received their loans they choose one of two investment projects. Project G pays the borrower a rate of return of r, with the entire value of the project disappears, the borrower defaults on the loan, and the lender receives nothing. Project B pays the borrower a rate of return of rB with probability p. And with probability 1 p, the entire value of the project disappears, the borrower defaults on the loan, and the lender receives nothing. We assume that r, < rb, Pg > Pb, and p,(1+r,) > Pr(1 + ri). probability pg. With probability 1 Pg: The lender can't distinguish between borrower types and so it charges all borrowers the same interest rate r. The lender lends an amount L and pays interest rp on funds acquired from depositors. (a) Which project would the lender prefer that the borrowers undertake? Explain. (b) Write down an expression for the profit that a borrower expects from Project G. (c) Write down an expression for the profit that a borrower expects from Project B. (d) Suppose rg = 0.07, r = value for r such that the borrower is indifferent between projects G and B. Show 0.08, , 0.99, 0.5, rp = 0.02, L = 10. Find the your work. (e) Plot the lender's expected profit function E(T) for values of r, between 0.00 and 0.10. Explain in words what is happening to the borrower pool at the disconti- nuity.

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

I have displayed the image Let me analyze it and answer the questions The image includes a problem about a competitive lender providing loans to borrowers who must choose between two projects G and B ... View full answer

Get step-by-step solutions from verified subject matter experts