Question: please solve all three question , ineed typed answer urgently GOLD MINING: RISING COSTS AND LIMITED CASH FLOW Gold mining requires businesses to take a

please solve all three question , ineed typed answer urgently

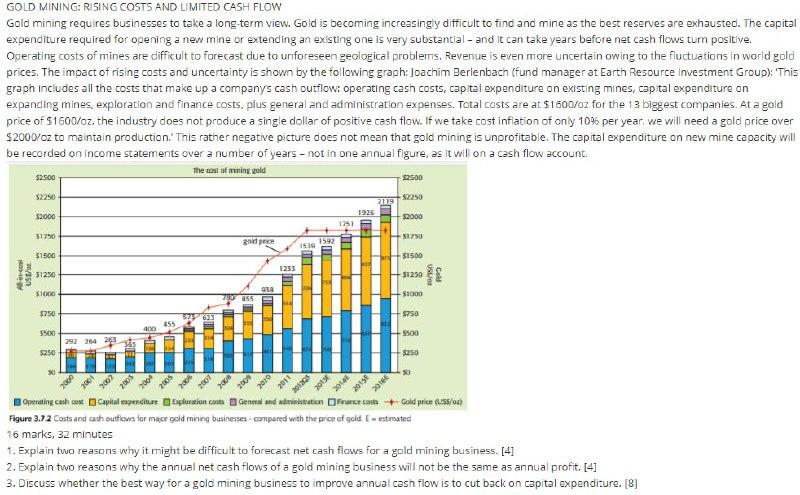

GOLD MINING: RISING COSTS AND LIMITED CASH FLOW Gold mining requires businesses to take a long-term view. Gold is becoming increasingly difficult to find and mine as the best reserves are exhausted. The capital expenditure required for opening a new mine or extending an existing one is very substantial - and it can take years before net cash flows turn positive. Operating costs of mines are difficult to forecast due to unforeseen geological problems. Revenue is even more uncertain owing to the fluctuations in world gold prices. The impact of rising costs and uncertainty is shown by the following graph: Joachim Berlenbach (fund manager at Earth Resource Investment Group): 'This graph includes all the costs that make up a companys cash outflow: operating cash costs, capital expenditure on existing mines, cap tal expenditure on expanding mines, exploration and finance costs, plus general and administration expenses. Total costs are at $1600/oz for the 13 biggest companies. At a gold price of 51600/oz. the industry does not produce a single dollar of positive cash flow. If we take cost inflation of only 10% per year we will need a gold price over S2000/oz to maintain production. This rather negative picture does not mean that gold mining is unprofitable. The capital expenditure on new mine capacity will be recorded on income statements over a number of years - not in one annual figure, as it will on a cash flow account. The cost of mining gold $2.500 52500 $2250 82250 $2000 2119 1925 1751 52000 $1750 galde 1730 1592 $1500 51500 2233 45ios! US$/or 51250 ARA $1000 780 -51000 $250 623 S750 4X 455 5500 9500 292 264 263 $250 $250 000 50 2005 2000 2005 2006 2010 2009 2008 2009 200 102 SLOT 2006 2016 201208 2015 2016 Operating canh cost capital expendiose beploraban costs General and administration Finance costs + Gold price (US5/08) Figure 3.72 Costs and cash outlows for macr gold mining businesses-compared with the price of gold. Ea estimated 16 marks, 32 minutes 1. Explain two reasons why it might be difficult to forecast net cash flows for a gold mining business. [4] 2. Explain two reasons why the annual net cash flows of a gold mining business will not be the same as annual profit. [4] 3. Discuss whether the best way for a gold mining business to improve annual cash flow is to cut back on capital expenditure. [8]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts