Question: Please solve all three questions, please do not answer if you cant answer all of them. thank you! Required informetion [The following information applies to

![to the questions displayed below] In 2023, Shery is claimed as a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eca2769ae54_11866eca27623786.jpg)

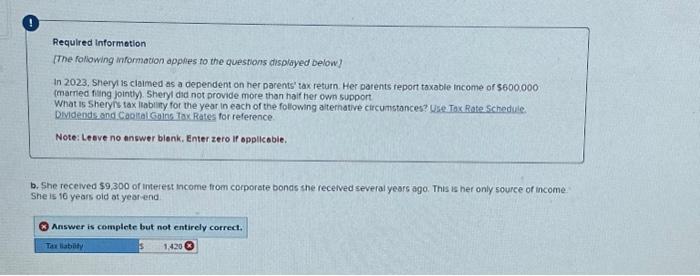

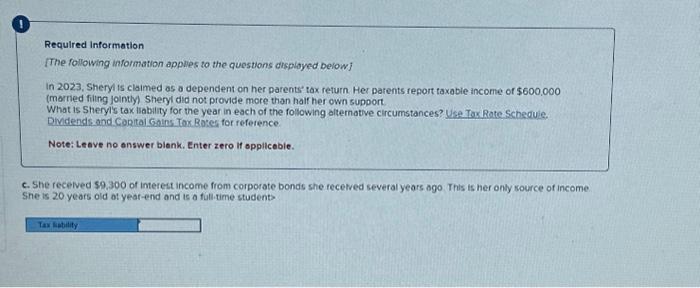

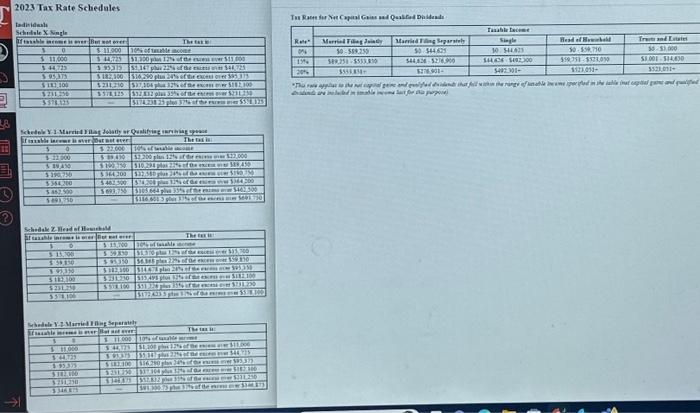

Required informetion [The following information applies to the questions displayed below] In 2023, Shery is claimed as a dependent on her parents' tax return. Her parents report taxable income of $600.000 (marred fing fointly). Sheryl did not provide more than haif her own support What is Sheryns tax liabiliny for the year in each of the following aiternative circumstances? Use Tax Rate Schedile. Dividendisend Caoltak Gains Tox Rates for reference. Note: Leove no answer bienk. Enter zero if opplicobie. b. She received $9,300 of interest income from corporate bonas she recelved several years ago. This is her only source of income She is 16 years oid ot yeoriend Answer is complete but not entirely correct. 2023 Tax Rate Schedales taditident Required Information [The following information applies to the questions chispilyed below] In 2023, Sheryl is claimed as a dependent on her parents' tox return Her parents report taxable income or $600,000 (morried filing Jointly) Sheryl did not provide more than halr her own support What is Sheryis tax iliability for the year in each of the following alternatve circumstances? Use Tax Rate Schecluie. Dividends and Copital Gains. Tox Botes for reference. Note: Leave no answer blank. Enter zero if opplicable. c. She recelved $9.300 of interest income from corporate bonds she recelved sevefal years ogo. This is her only source of income She is 20 years old at year-end and is a fullime student: Required Information [The following information applies to the questions displayed bolow] In 2023, Sheryl is claimed as a dependent on her porents' tax return. Her parents report taxable income of $600,000 (married filing jointly) Sheryi did not provide more than half her own support What is Sheryl's tax liability for the year in each of the following alternative circumstances? Use Tax Rote Schecule, Dividends and Copitol Goins Tox Rates for reference Note: Leave no answer blank. Enter zero if opplicoble. d. She recelved $9.300 of qualfied dividend income. This is her only source of income. She is 16 years old ot yeaf-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts