Question: please solve all Wael Ramel | 12/6/19 11:22 PM Save Homework: HW5-R&R Score: 0 of 1 pt P8-13 (similar to) 6 of 14 (5 complete)

please solve all

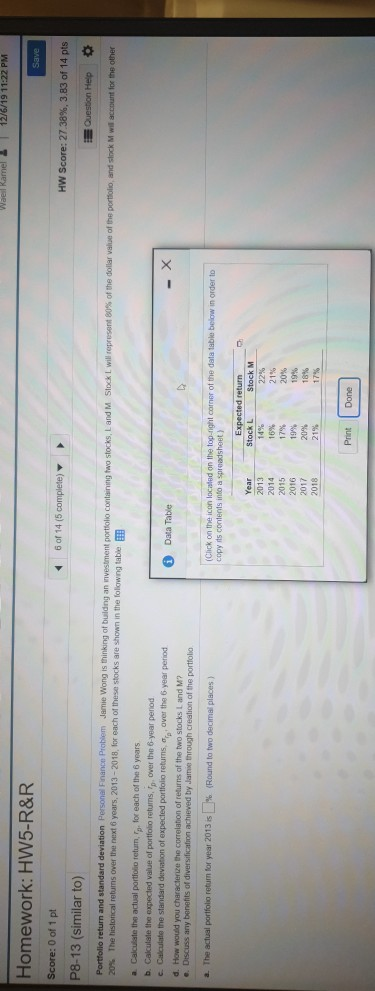

Wael Ramel | 12/6/19 11:22 PM Save Homework: HW5-R&R Score: 0 of 1 pt P8-13 (similar to) 6 of 14 (5 complete) HW Score: 27.38%, 3.83 of 14 pts Question Help Portfolio return and standard deviation Personal Finance Problem Jamie Wong is thinking of building an investment portfolio containing two stocks, Land M 20% The historical returns over the next 6 years, 2013 - 2018, for each of these stocks are shown in the following table Stock I will represent 80% of the dollar value of the portfolio and stock M wil account for the other a Calculate the actual portfolio return for each of the years b. Calculate the expected value of portfolio retums, p. Over the 6 year period Calculate the standard deviation of expected portfolio returns over the year period d. How would you characterize the correlation of returns of the two stocks Land M? e. Discuss any benefits of diversification achieved by Jane through creation of the portfolio Data Table a. The actual portfolio return for year 2013 is % (Round to two decimal places) (Click on the icon located on the top right corner of the data table below in order to copy its contents into a spreadsheet) 22 Year 2013 2014 2015 2016 2017 2018 Expected return Stock L Stock M 14% 10% 21% 179% 20% 19 19% 20% 18% 21 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts