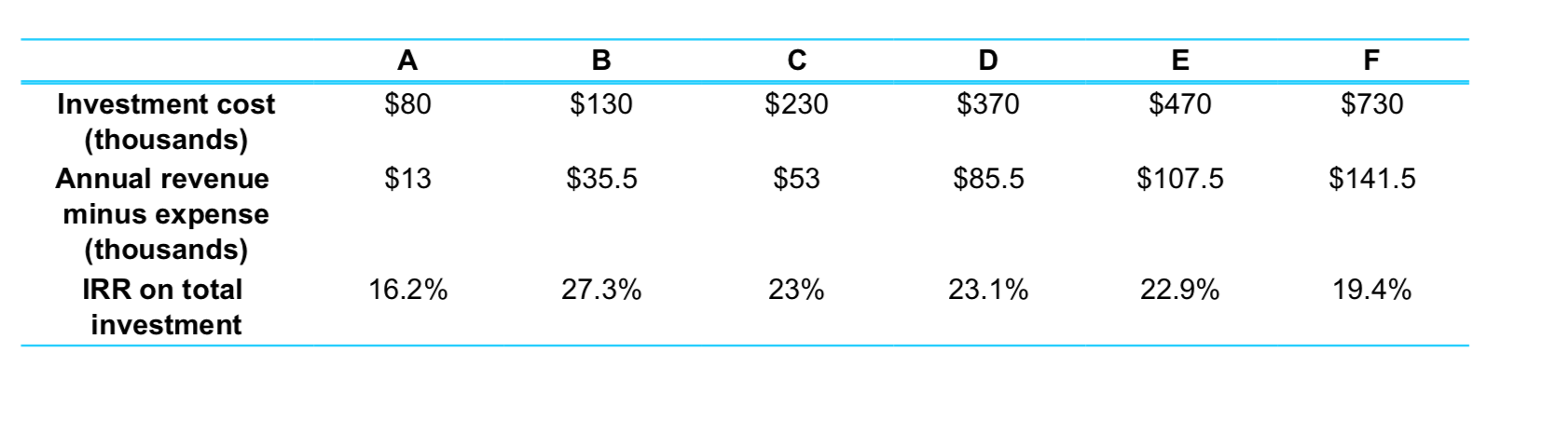

Question: Please Solve Also for Third, fourth, fifth, sixth choice alternative B F $80 $130 $230 $370 $470 $730 $13 $35.5 $53 $85.5 $107.5 $141.5 Investment

Please Solve Also for Third, fourth, fifth, sixth choice alternative

Please Solve Also for Third, fourth, fifth, sixth choice alternative

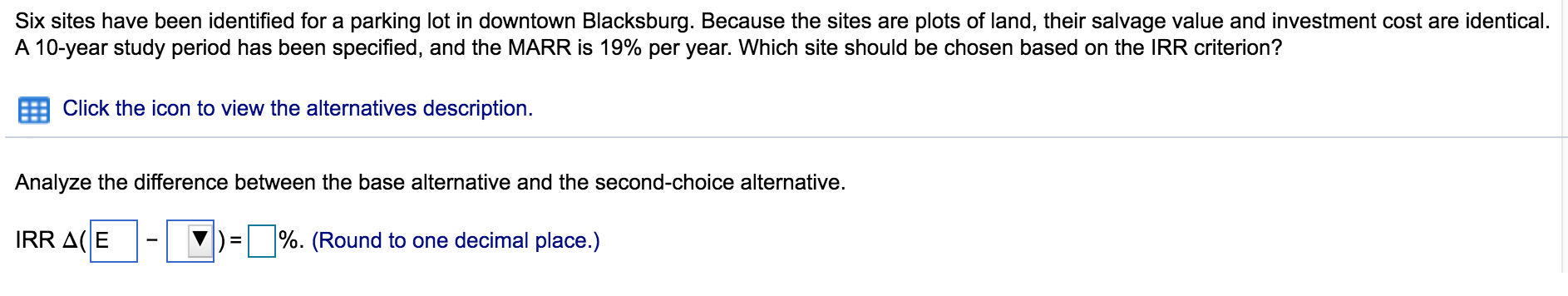

B F $80 $130 $230 $370 $470 $730 $13 $35.5 $53 $85.5 $107.5 $141.5 Investment cost (thousands) Annual revenue minus expense (thousands) IRR on total investment 16.2% 27.3% 23% 23.1% 22.9% 19.4% Six sites have been identified for a parking lot in downtown Blacksburg. Because the sites are plots of land, their salvage value and investment cost are identical. A 10-year study period has been specified, and the MARR is 19% per year. Which site should be chosen based on the IRR criterion? Click the icon to view the alternatives description. Analyze the difference between the base alternative and the second-choice alternative. IRR AE - )- %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts