Question: Please solve an d show work. THank you. Complete this question by entering your answers in the tabs below. Prepare the cash flows from operating

Please solve an

![(Indlrect method) [LO21-3, 21-4] The income statement and a schedule reconciling cash](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e3135c424dd_65966e3135be7d60.jpg) d show work. THank you.

d show work. THank you.

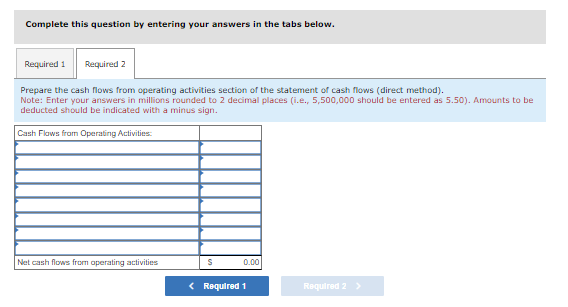

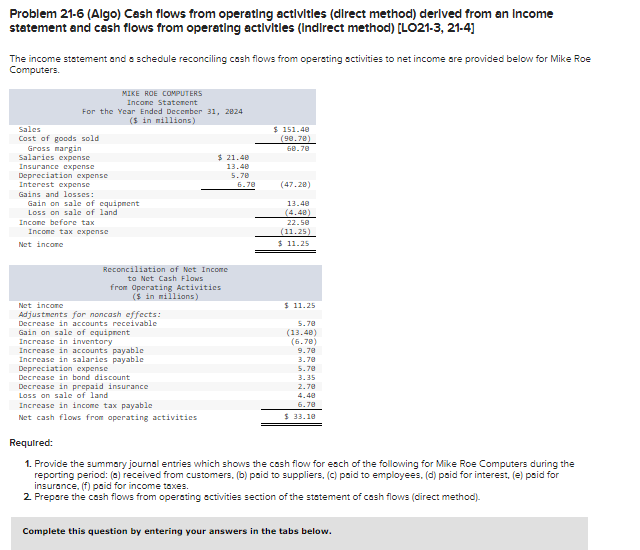

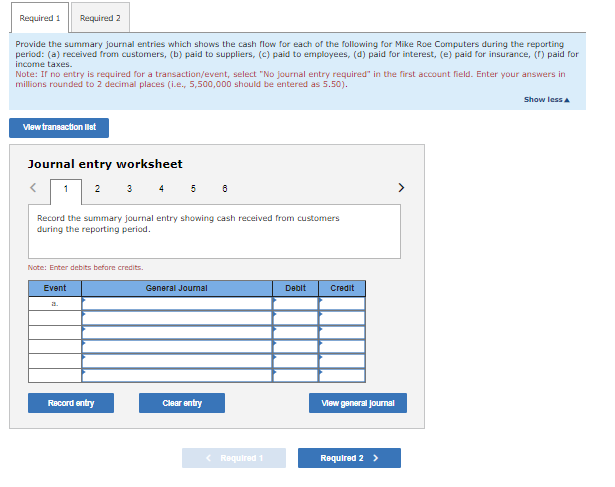

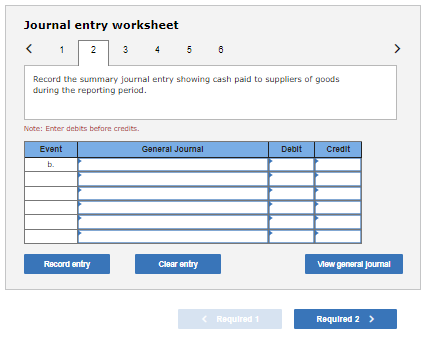

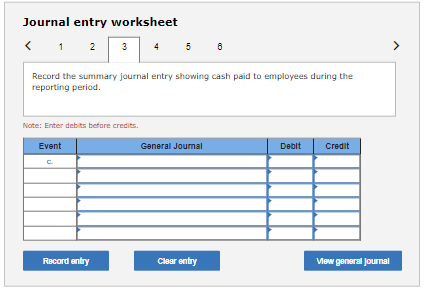

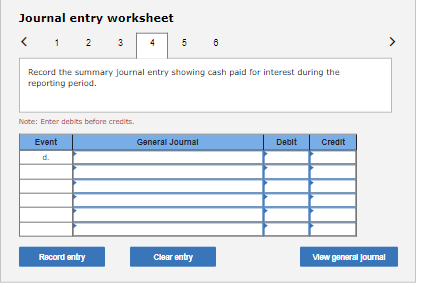

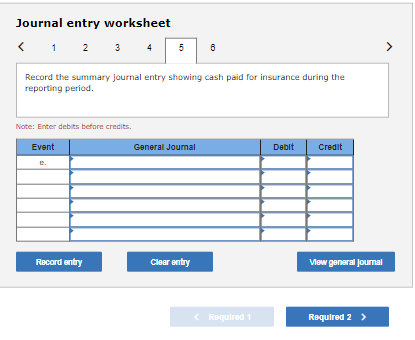

Complete this question by entering your answers in the tabs below. Prepare the cash flows from operating activities section of the statement of cash flows (direct method). Note: Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50). Amounts to be deducted should be indicated with a minus sign. Problem 21-6 (Algo) Cash flows from operating activlties (dlrect method) derlved from an Income statement and cash flows from operating actlvlties (Indlrect method) [LO21-3, 21-4] The income statement and a schedule reconciling cash flows from operating sctivities to net income are provided below for Mike Roe Computers. Requlred: 1. Provide the summary journal entries which shows the cash flow for esch of the following for Mike Roe Computers during the reporting period: (a) received from customers, (b) poid to suppliers, (c) poid to employees, (d) poid for interest, (e) poid for insurance, (f) paid for income toxes. 2. Prepere the cosh flows from operating ectivities section of the statement of cash flows (direct method). Complete this question by entering your answers in the tabs below. Provide the summary journal entries which shows the cash flow for each of the following for Mike Roe Computers during the reporting period: (a) received from customers, (b) paid to suppliers, (c) paid to employees, (d) paid for interest, (e) paid for insurance, (f) paid for income taxes. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e. 5,500,000 should be entered as 5.50). Journal entry worksheet 2345 Record the summary journal entry showing cash received from customers during the reporting period. Note: Enter debits before credits. Journal entry worksheet 1 345 Record the summary journal entry showing cash paid to suppliers of goods during the reporting period. Note: Enter debits befure credits. Journal entry worksheet 6 Record the summary journal entry showing cash paid to employees during the reporting period. Note: Enter debits before credits. Journal entry worksheet 8 Record the summary journal entry showing cash paid for interest during the reporting period. Note: Enter debits befure crecits. Journal entry worksheet Record the summary journal entry showing cash paid for insurance during the reporting period. Note: Enter debits before credits. Journal entry worksheet Record the summary journal entry showing cash paid for income taxes during the reporting period. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts