Question: please solve and explain every question step by step. please explain how you got every number, be specific. show all work 10. Johnson Corp. has

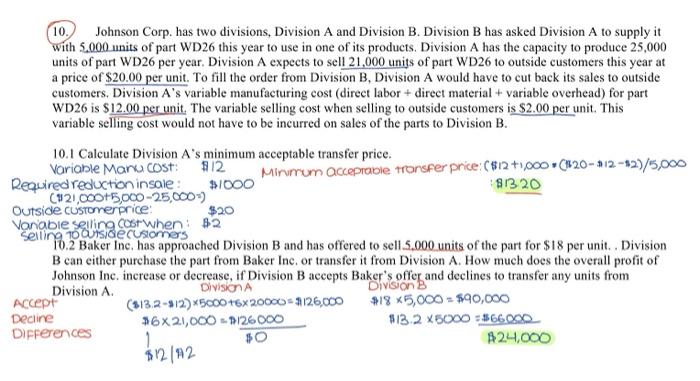

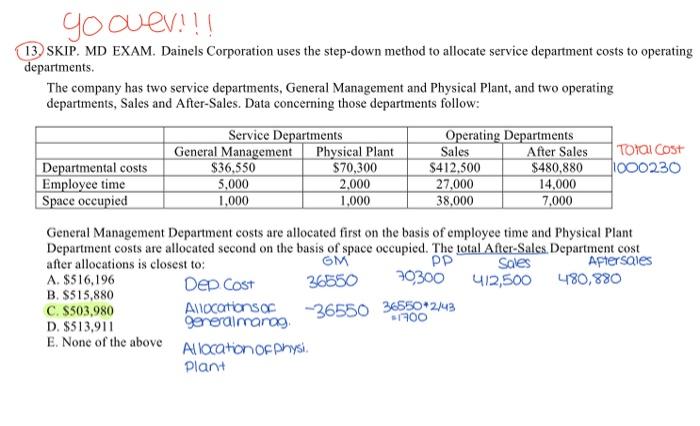

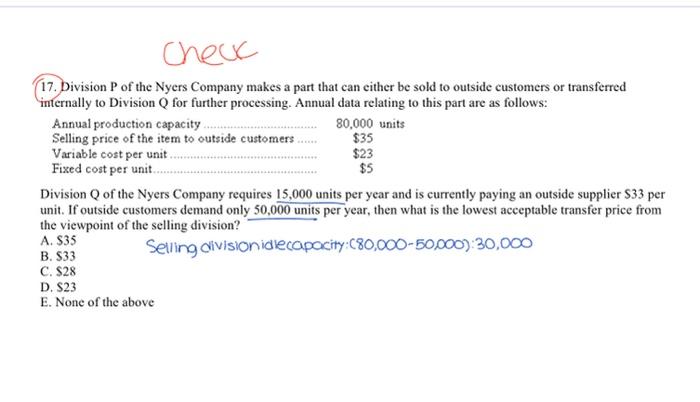

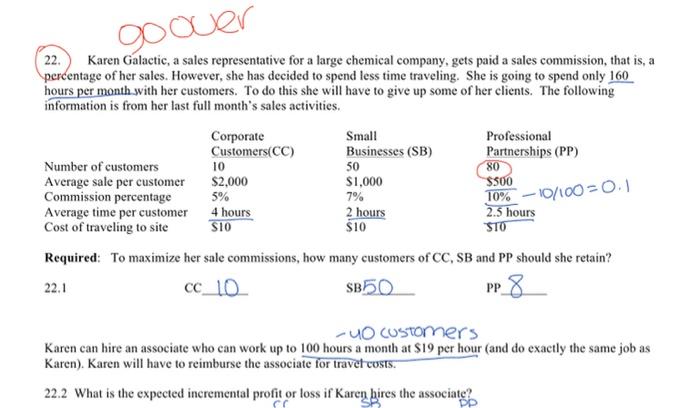

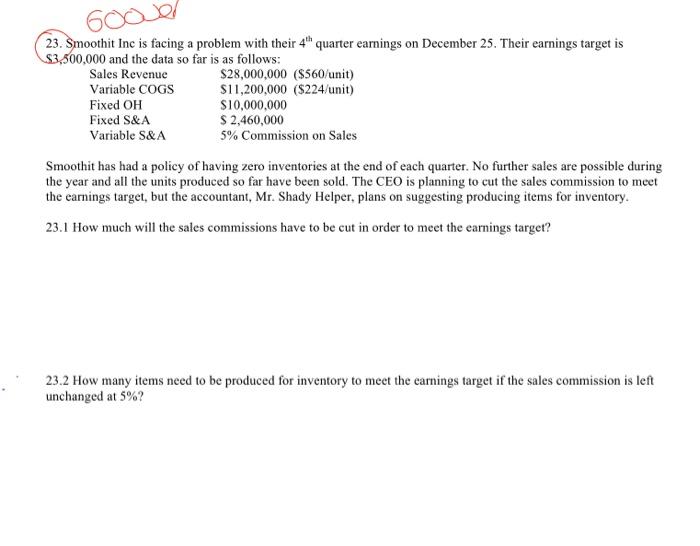

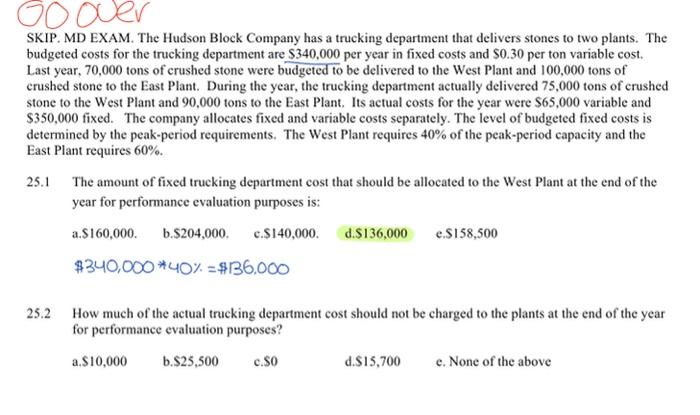

10. Johnson Corp. has two divisions, Division A and Division B. Division B has asked Division A to supply it With 5,000 units of part WD26 this year to use in one of its products. Division A has the capacity to produce 25,000 units of part WD26 per year. Division A expects to sell 21,000 units of part WD26 to outside customers this year at a price of $20.00 per unit. To fill the order from Division B, Division A would have to cut back its sales to outside customers. Division A's variable manufacturing cost (direct labor + direct material + variable overhead) for part WD26 is $12.00 per unit. The variable selling cost when selling to outside customers is $2.00 per unit. This variable selling cost would not have to be incurred on sales of the parts to Division B. 13. SKIP. MD EXAM. Dainels Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, General Management and Physical Plant, and two operating departments, Sales and After-Sales. Data concerning those departments follow: TO1al Cost 00030 General Management Department costs are allocated first on the basis of employee time and Physical Plant 17. Division P of the Nyers Company makes a part that can either be sold to outside customers or transferred imternally to Division Q for further processing. Annual data relating to this part are as follows: Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. If outside customers demand only 50,000 units per year, then what is the lowest acceptable transfer price from the viewpoint of the selling division? A. $35 Selling divisionidecapacity: (80,00050,000):30,000 B. $33 C. $28 D. $23 E. None of the above 22. Karen Galactic, a sales representative for a large chemical company, gets paid a sales commission, that is, a percentage of her sales. However, she has decided to spend less time traveling. She is going to spend only 160 hours per month swith her customers. To do this she will have to give up some of her clients. The following. information is from her last full month's sales activities. Required: To maximize her sale commissions, how many customers of CC,SB and PP should she retain? 22.1 -40 customers Karen can hire an associate who can work up to 100 hours a month at $19 per hour (and do exactly the same job as Karen). Karen will have to reimburse the associate for travet coss. 22.2 What is the expected incremental profit or loss if Karen hires the associate? 23. Smoothit Inc is facing a problem with their 4th quarter earnings on December 25 . Their earnings target is $3,500.000 and the data so far is as follows: Smoothit has had a policy of having zero inventories at the end of each quarter. No further sales are possible during the year and all the units produced so far have been sold. The CEO is planning to cut the sales commission to meet the earnings target, but the accountant, Mr. Shady Helper, plans on suggesting producing items for inventory. 23.1 How much will the sales commissions have to be cut in order to meet the earnings target? 23.2 How many items need to be produced for inventory to meet the earnings target if the sales commission is left unchanged at 5% ? SKIP. MD EXAM. The Hudson Block Company has a trucking department that delivers stones to two plants. The budgeted costs for the trucking department are $340.000 per year in fixed costs and $0.30 per ton variable cost. Last year, 70,000 tons of crushed stone were budgeted to be delivered to the West Plant and 100,000 tons of crushed stone to the East Plant. During the year, the trucking department actually delivered 75,000 tons of crushed stone to the West Plant and 90,000 tons to the East Plant. Its actual costs for the year were $65,000 variable and $350,000 fixed. The company allocates fixed and variable costs separately. The level of budgeted fixed costs is determined by the peak-period requirements. The West Plant requires 40% of the peak-period capacity and the East Plant requires 60% 25.1 The amount of fixed trucking department cost that should be allocated to the West Plant at the end of the year for performance evaluation purposes is: a.$160,000.b.$204,000c.$140,000d.$136,000e.$158,500 $340,00040%=$36,000 25.2 How much of the actual trucking department cost should not be charged to the plants at the end of the year for performance evaluation purposes? a. $10,000 b. $25,500 c. $0 d.S15,700 e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts