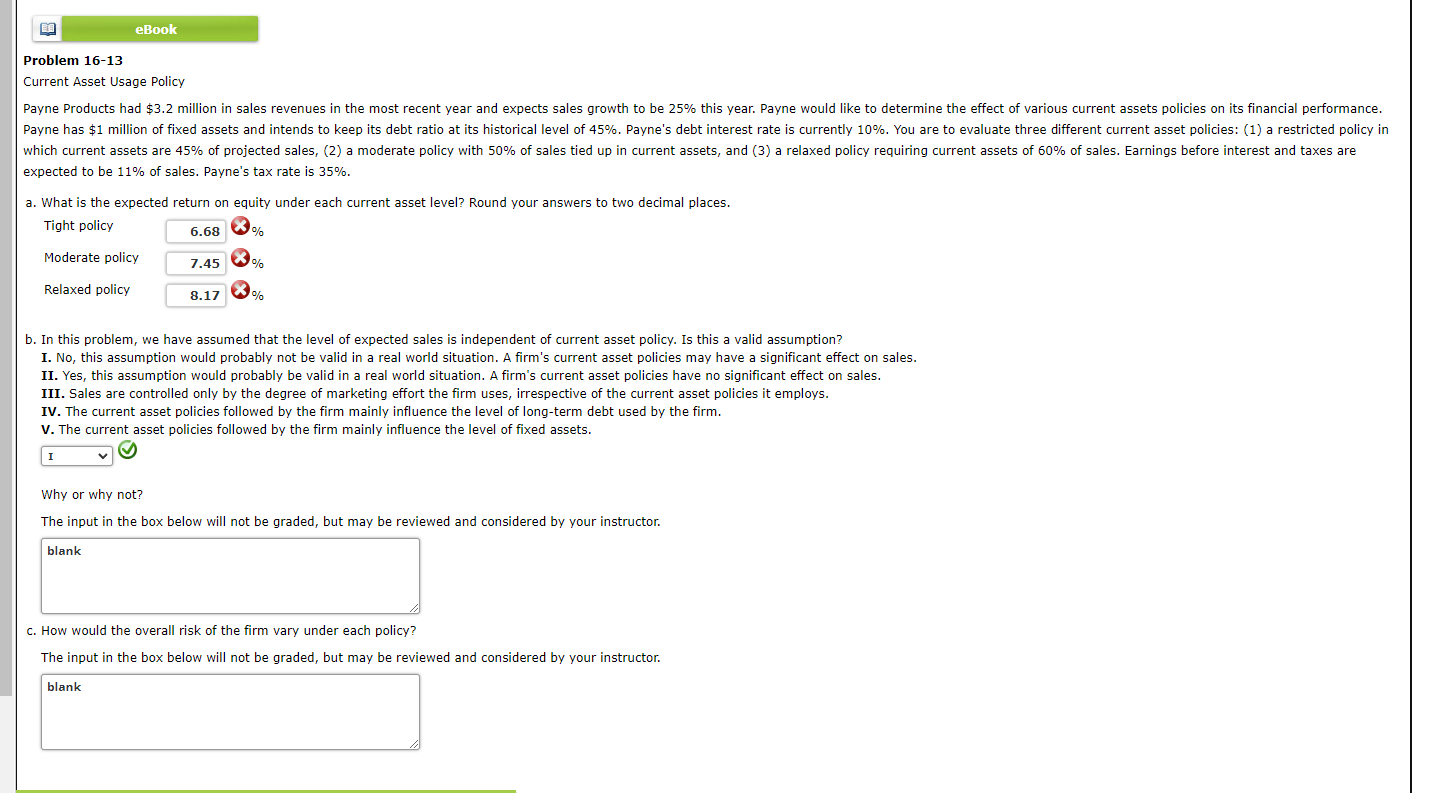

Question: Please solve and explain. Mhy answers are not correct Current Asset Usage Policy expected to be 11% of sales. Payne's tax rate is 35%. a.

Please solve and explain. Mhy answers are not correct

Current Asset Usage Policy expected to be 11% of sales. Payne's tax rate is 35%. a. What is the expected return on equity under each current asset level? Round your answers to two decimal places. Tight policy % Moderate policy % Relaxed policy % b. In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? I. No, this assumption would probably not be valid in a real world situation. A firm's current asset policies may have a significant effect on sales. II. Yes, this assumption would probably be valid in a real world situation. A firm's current asset policies have no significant effect on sales. III. Sales are controlled only by the degree of marketing effort the firm uses, irrespective of the current asset policies it employs. IV. The current asset policies followed by the firm mainly influence the level of long-term debt used by the firm. V. The current asset policies followed by the firm mainly influence the level of fixed assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts