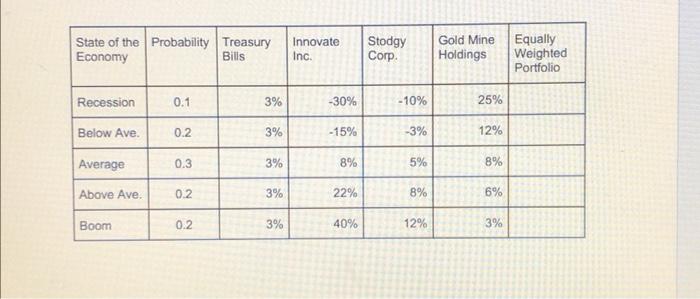

Question: please solve and explain. only #3 and 4. set up in excel begin{tabular}{|l|l|l|l|l|l|l|} hline State of the Economy & Probability & multicolumn{1}{|l|}{ Treasury Bills }

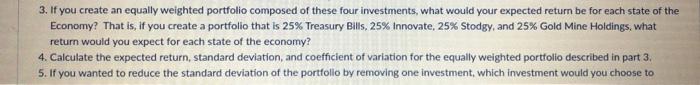

\begin{tabular}{|l|l|l|l|l|l|l|} \hline State of the Economy & Probability & \multicolumn{1}{|l|}{ Treasury Bills } & Innovate Inc. & Stodgy Corp. & \multicolumn{1}{l|}{ Gold Mine Holdings } & Equally Weighted Portfolio \\ \hline Recession & 0.1 & 3% & 30% & 10% & 25% & \\ \hline Below Ave. & 0.2 & 3% & 15% & 3% & 12% & \\ \hline Average & 0.3 & 3% & 8% & 5% & 8% & \\ \hline Above Ave. & 0.2 & 3% & 22% & 8% & 6% & \\ \hline Boom & 0.2 & 3% & 40% & 12% & 3% & \\ \hline \end{tabular} 3. If you create an equally weighted portfolio composed of these four investments, what would your expected return be for each state of the Economy? That is, if you create a portfolio that is 25% Treasury Bills, 25% Innovate, 25% Stodgy, and 25% Gold Mine Holdings, what return would you expect for each state of the economy? 4. Calculate the expected return, standard deviation, and coefficient of variation for the equally weighted portfolio described in part 3. 5. If you wanted to reduce the standard deviation of the portfollo by removing one investment, which investment would you choose to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts