Question: Please solve and explain step by step. Thank you so much. Summer Corporation purchased inventory costing $140,000 and sold 80% of the goods for $187,000.

Please solve and explain step by step. Thank you so much.

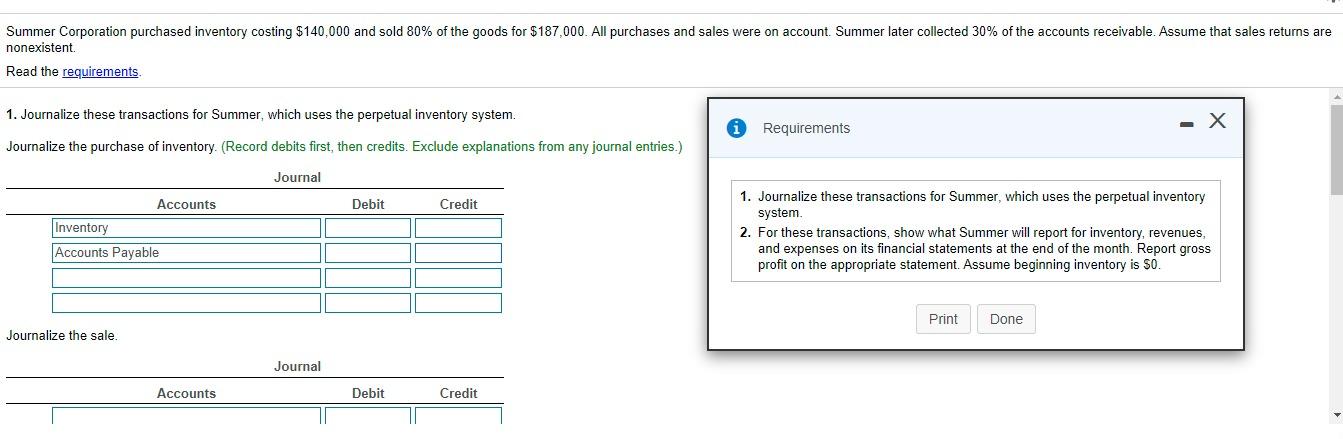

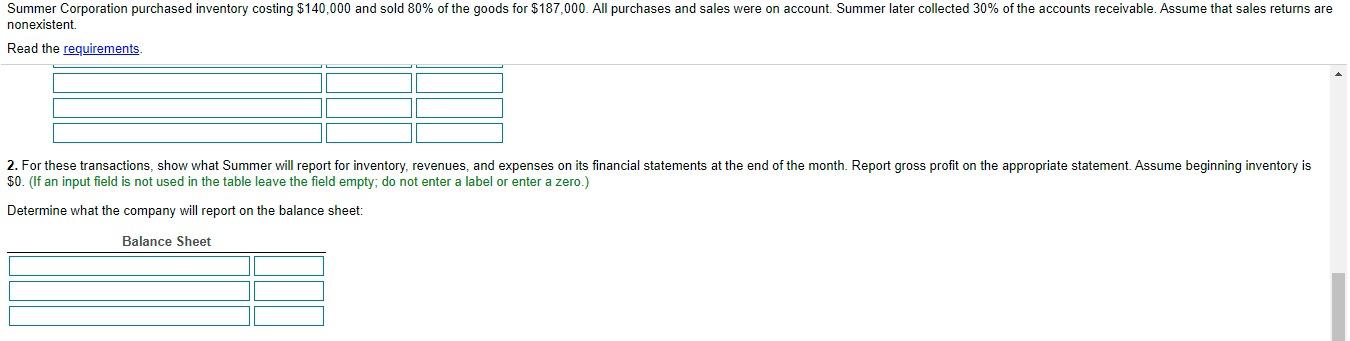

Summer Corporation purchased inventory costing $140,000 and sold 80% of the goods for $187,000. All purchases and sales were on account. Summer later collected 30% of the accounts receivable. Assume that sales returns are nonexistent. Read the requirements 2. For these transactions, show what Summer will report for inventory, revenues, and expenses on its financial statements at the end of the month. Report gross profit on the appropriate statement. Assume beginning inventory is $0. (If an input field is not used in the table leave the field empty, do not enter a label or enter a zero.) Determine what the company will report on the balance sheet: Balance Sheet Determine what the company will report on the income statement: Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts