Question: Please solve and explain this question in an organized and detailed fashion. Comparison of a Dual Currency Bond vs. a Conventional Bond Imagine the Japanese

Please solve and explain this question in an organized and detailed fashion.

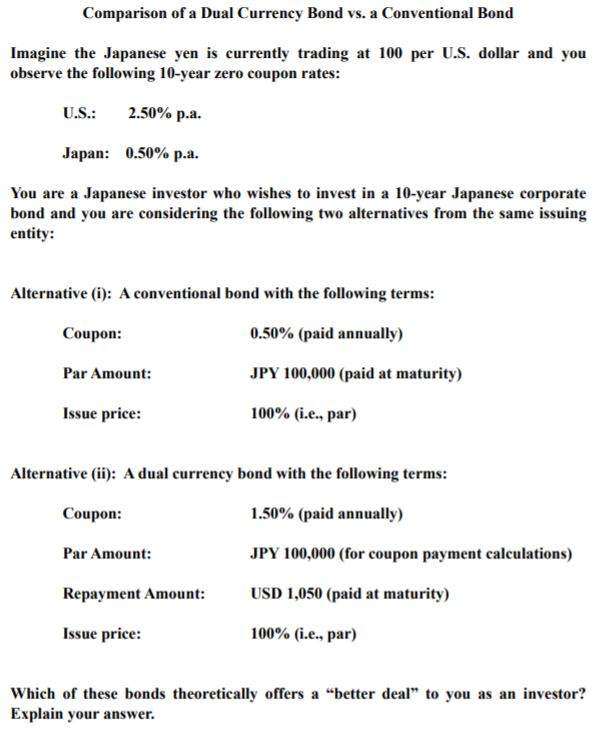

Comparison of a Dual Currency Bond vs. a Conventional Bond Imagine the Japanese yen is currently trading at 100 per U.S. dollar and you observe the following 10-year zero coupon rates: U.S.: 2.50% p.a. Japan: 0.50% p.a. You are a Japanese investor who wishes to invest in a 10-year Japanese corporate bond and you are considering the following two alternatives from the same issuing entity: Alternative (i): A conventional bond with the following terms: Coupon: 0.50% (paid annually) Par Amount: JPY 100,000 (paid at maturity) Issue price: 100% (i.e., par) Alternative (ii): A dual currency bond with the following terms: Coupon: 1.50% (paid annually) Par Amount: JPY 100,000 (for coupon payment calculations) Repayment Amount: USD 1, 050 (paid at maturity) Issue price: 100% (i.e., par) Which of these bonds theoretically offers a "better deal" to you as an investor? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts