Question: please solve and show all work. do not copy same answes from other chegg problems please. make sure to read it carfully. thank you Questions

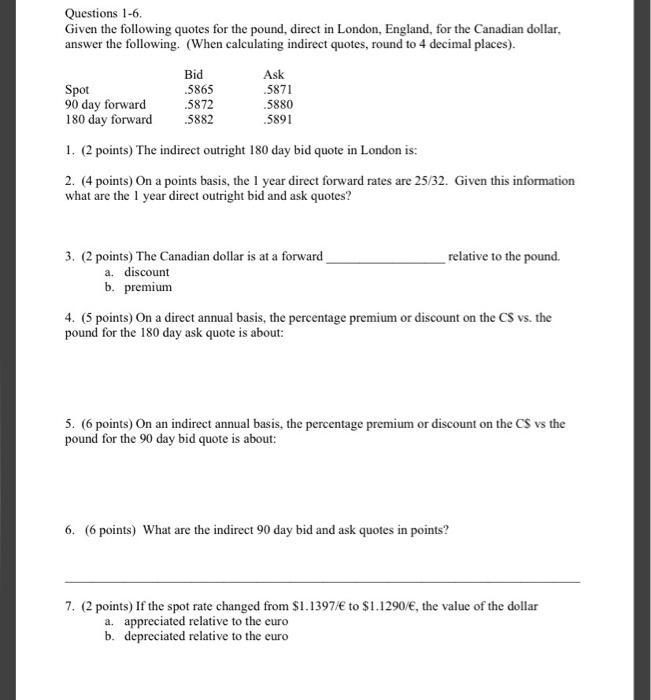

Questions 1-6. Given the following quotes for the pound, direct in London, England, for the Canadian dollar, answer the following. (When calculating indirect quotes, round to 4 decimal places). Bid Ask Spot .5865 .5871 90 day forward .5872 .5880 180 day forward 5882 .5891 1. (2 points) The indirect outright 180 day bid quote in London is: 2. (4 points) On a points basis, the 1 year direct forward rates are 25/32. Given this information what are the 1 year direct outright bid and ask quotes? 3. (2 points) The Canadian dollar is at a forward relative to the pound. a. discount b. premium 4. (5 points) On a direct annual basis, the percentage premium or discount on the CS vs. the pound for the 180 day ask quote is about: 5. (6 points) On an indirect annual basis, the percentage premium or discount on the CS vs the pound for the 90 day bid quote is about: 6. (6 points) What are the indirect 90 day bid and ask quotes in points? 7. (2 points) If the spot rate changed from $1.1397/ to $1.1290/, the value of the dollar a. appreciated relative to the euro b. depreciated relative to the euro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts