Question: Please solve and show all work for B and C. The answers are included. I am not sure how to solve. 4. (Buy an option,

Please solve and show all work for B and C. The answers are included. I am not sure how to solve.

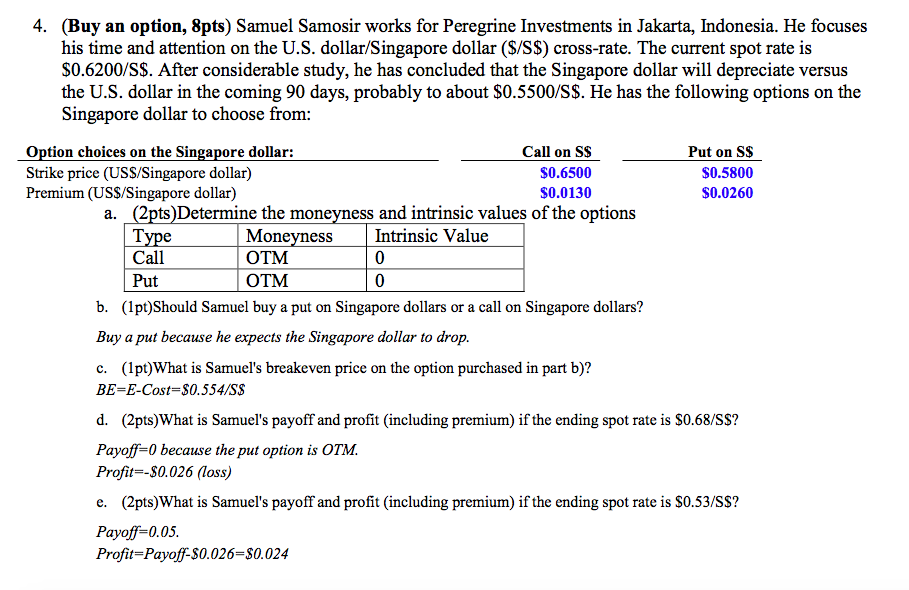

4. (Buy an option, 8pts Samuel Samosir works for Peregrine Investments in Jakarta, Indonesia. He focuses his time and attention on the U.S. dollar Singapore dollar ($/S$) cross-rate. The current spot rate is $0.6200/S$. After considerable study, he has concluded that the Singapore dollar will depreciate versus the U.S. dollar in the coming 90 days, probably to about $0.5500/S$. He has the following options on the Singapore dollar to choose from: option choices on the Singapore dollar: Call on S$ Put on S$ $0.5800 Strike price (USS/Singapore dollar) $0.6500 $0.0130 $0.0260 Premium (US$/Singapore dollar) a. (2pts)Determine the mone and intrinsic values of the options Type Money ness Intrinsic Value OTM Call OTM Put b. (1ptShould Samuel buy a put on Singapore dollars or a call on Singapore dollars? Buy a put because he expects the Singapore dollar to drop. c. (1pt)What is Samuel's breakeven price on the option purchased in part b)? BE E-Cost S0.554/SS d. (2pts)What is Samuel's payoff and profit (including premium) if the ending spot rate is S0.68/ss? Payoff 0 because the put option is OTM. Profits -S0.026 (loss) e. (2pts)What is Samuel's payoff and profit (including premium) if the ending spot rate is S0.53/ss? Payoff 0.05. Profits Payoff-S0.026-S0.024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts