Question: PLEASE SOLVE AND SHOW ALL WORK THANKS Asahi Technology has a contract to build a network for a customer for a total sales price of

PLEASE SOLVE AND SHOW ALL WORK THANKS

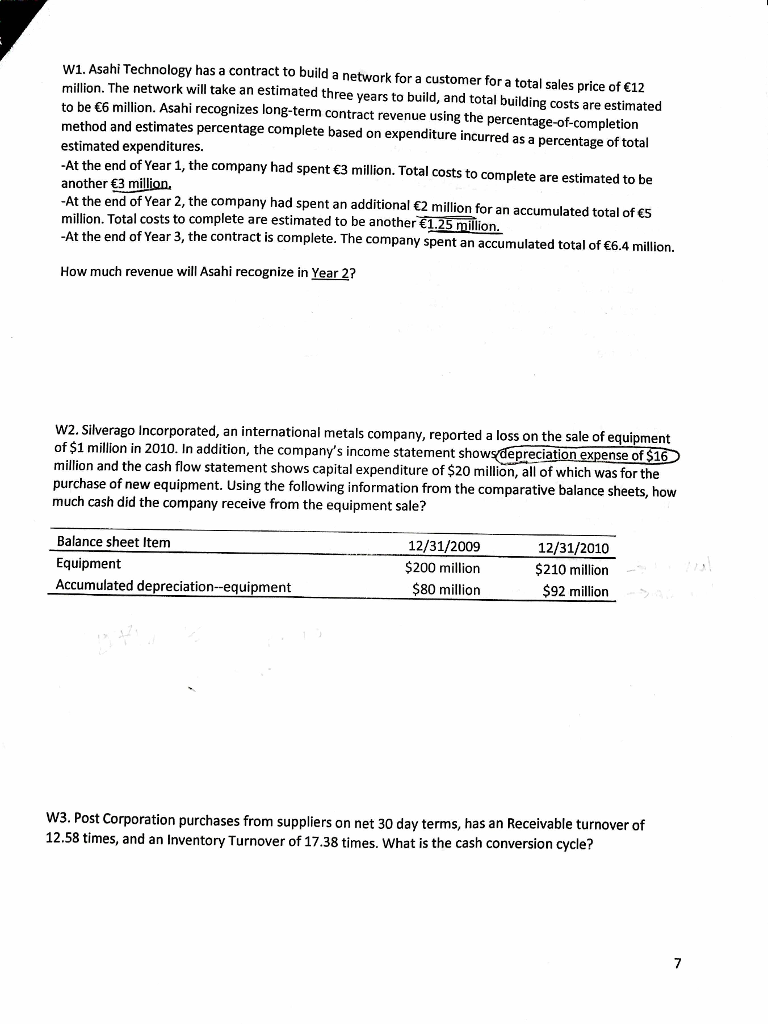

Asahi Technology has a contract to build a network for a customer for a total sales price of euro 12 million. The network will take an estimated three years to build, and total building costs are estimated to be euro 6 million. Asahi recognizes long-term contract revenue using the percentage-of-completion method and estimates percentage complete based on expenditure incurred as a percentage of total estimated expenditures. -At the end of Year 1, the company had spent euro 3 million. Total costs to complete are estimated to be another euro 3 million. -At the end of Year 2, the company had spent an additional euro 2 million for an accumulated total of euro 5 million. Total costs to complete are estimated to be another euro1.25 million. -At the end of Year 3, the contract is complete. The company spent an accumulated total of euro 6.4 million. How much revenue will Asahi recognize in Year 2? Silverado Incorporated, an international metals company, reported a loss on the sale of equipment of $1 million in 2010. In addition, the company's income statement shows depreciation expense of million and the cash flow statement shows capital expenditure of $20 million, all of which was for the purchase of new equipment. Using the following information from the comparative balance sheets, how much cash did the company receive from the equipment sale? Post Corporation purchases from suppliers on net 30 day terms, has a Receivable turnover of 12.58 times, and an Inventory Turnover of 17.38 times. What is the cash conversion cycle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts