Question: Please solve and show your work for A, B, C, D, and E. Please include formula and how you got to the answer. Please include

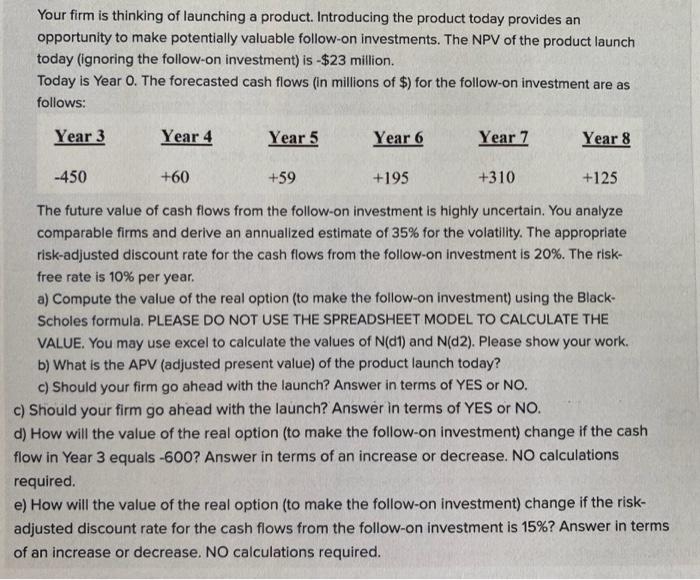

Your firm is thinking of launching a product. Introducing the product today provides an opportunity to make potentially valuable follow on investments. The NPV of the product launch today (ignoring the follow-on investment) is - $23 million. Today is Year 0. The forecasted cash flows (in millions of $) for the follow-on investment are as follows: Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 -450 +60 +59 +195 +310 +125 The future value of cash flows from the follow-on investment is highly uncertain. You analyze comparable firms and derive an annualized estimate of 35% for the volatility. The appropriate risk-adjusted discount rate for the cash flows from the followon investment is 20%. The risk- free rate is 10% per year. a) Compute the value of the real option (to make the follow-on investment) using the Black- Scholes formula, PLEASE DO NOT USE THE SPREADSHEET MODEL TO CALCULATE THE VALUE. You may use excel to calculate the values of N(dt) and N(D2). Please show your work. b) What is the APV (adjusted present value) of the product launch today? c) Should your firm go ahead with the launch? Answer in terms of YES or NO. c) Should your firm go ahead with the launch? Answer in terms of YES or NO. d) How will the value of the real option to make the follow-on investment) change if the cash flow in Year 3 equals -600? Answer in terms of an increase or decrease. No calculations required. e) How will the value of the real option to make the follow-on investment) change if the risk- adjusted discount rate for the cash flows from the follow-on investment is 15%? Answer in terms of an increase or decrease. NO calculations required. Your firm is thinking of launching a product. Introducing the product today provides an opportunity to make potentially valuable follow on investments. The NPV of the product launch today (ignoring the follow-on investment) is - $23 million. Today is Year 0. The forecasted cash flows (in millions of $) for the follow-on investment are as follows: Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 -450 +60 +59 +195 +310 +125 The future value of cash flows from the follow-on investment is highly uncertain. You analyze comparable firms and derive an annualized estimate of 35% for the volatility. The appropriate risk-adjusted discount rate for the cash flows from the followon investment is 20%. The risk- free rate is 10% per year. a) Compute the value of the real option (to make the follow-on investment) using the Black- Scholes formula, PLEASE DO NOT USE THE SPREADSHEET MODEL TO CALCULATE THE VALUE. You may use excel to calculate the values of N(dt) and N(D2). Please show your work. b) What is the APV (adjusted present value) of the product launch today? c) Should your firm go ahead with the launch? Answer in terms of YES or NO. c) Should your firm go ahead with the launch? Answer in terms of YES or NO. d) How will the value of the real option to make the follow-on investment) change if the cash flow in Year 3 equals -600? Answer in terms of an increase or decrease. No calculations required. e) How will the value of the real option to make the follow-on investment) change if the risk- adjusted discount rate for the cash flows from the follow-on investment is 15%? Answer in terms of an increase or decrease. NO calculations required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts