Question: --------------- Please Solve As soon as Solve quickly I get you thumbs up directly Thank's Abdul-Rahim Taysir Question 8. Sbitany Co is considering the following

--------------- Please Solve As soon as Solve quickly I get you thumbs up directly Thank's Abdul-Rahim Taysir

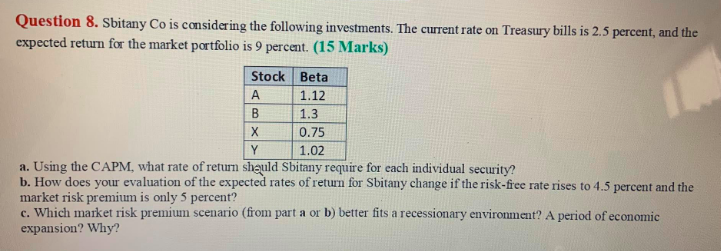

Question 8. Sbitany Co is considering the following investments. The current rate on Treasury bills is 2.5 percent, and the expected return for the market portfolio is 9 percent. (15 Marks) Stock Beta A 1.12 B 1.3 0.75 Y 1.02 a. Using the CAPM, what rate of return should Sbitany require for each individual security? b. How does your evaluation of the expected rates of return for Sbitany change if the risk-free rate rises to 4.5 percent and the market risk premium is only 5 percent? c. Which market risk premium scenario (from part a or b) better fits a recessionary environment? A period of economic expansion? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts