Question: --------------- Please Solve As soon as Solve quickly I get you thumbs up directly Thank's Abdul-Rahim Taysir , JAWWAL 57% 12:37 PM itc.birzeit.edu E Your

--------------- Please Solve As soon as Solve quickly I get you thumbs up directly Thank's Abdul-Rahim Taysir

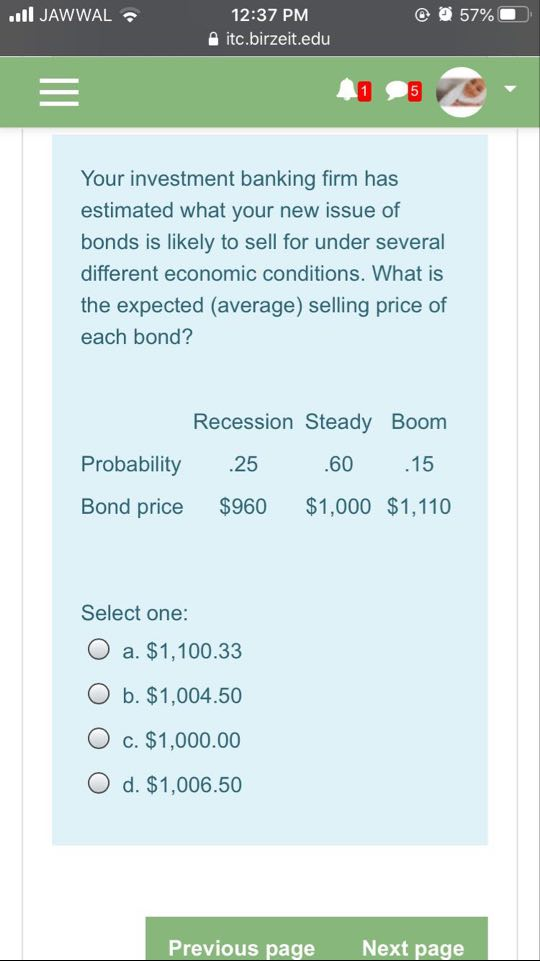

, JAWWAL 57% 12:37 PM itc.birzeit.edu E Your investment banking firm has estimated what your new issue of bonds is likely to sell for under several different economic conditions. What is the expected (average) selling price of each bond? Recession Steady Boom Probability .25 .60 .15 Bond price $960 $1,000 $1,110 Select one: O a. $1,100.33 O b. $1,004.50 O c. $1,000.00 O d. $1,006.50 Previous page Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts