Question: Please solve As soon as Solve quickly i get you thumbs up directly Thank's Abdul-Rahim Taysir 10. P is the risky portfolio and F is

Please solve As soon as Solve quickly i get you thumbs up directly Thank's Abdul-Rahim Taysir

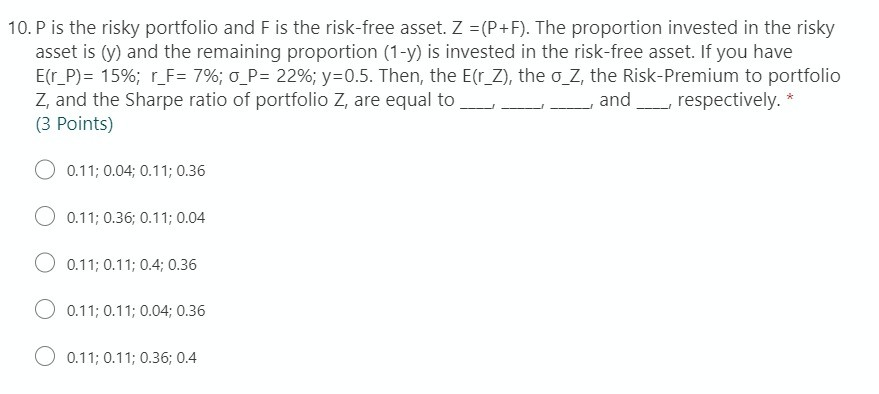

10. P is the risky portfolio and F is the risk-free asset. Z =(P+F). The proportion invested in the risky asset is (y) and the remaining proportion (1-y) is invested in the risk-free asset. If you have E(r_P)= 15%; r_F= 7%; 0_P= 22%;y=0.5. Then, the E(r_Z), the o_Z, the Risk-Premium to portfolio Z, and the Sharpe ratio of portfolio Z, are equal to and_, respectively. * (3 Points) 0 0.11;0.04; 0.11; 0.36 0.11; 0.36; 0.11; 0.04 O 0.11;0.11; 0.4; 0.36 O 0.11;0.11; 0.04; 0.36 O 0.11;0.11; 0.36; 0.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts