Question: please solve asap. please show all work and steps and how you got the answers. thank you so much. will rate 5 stars if done

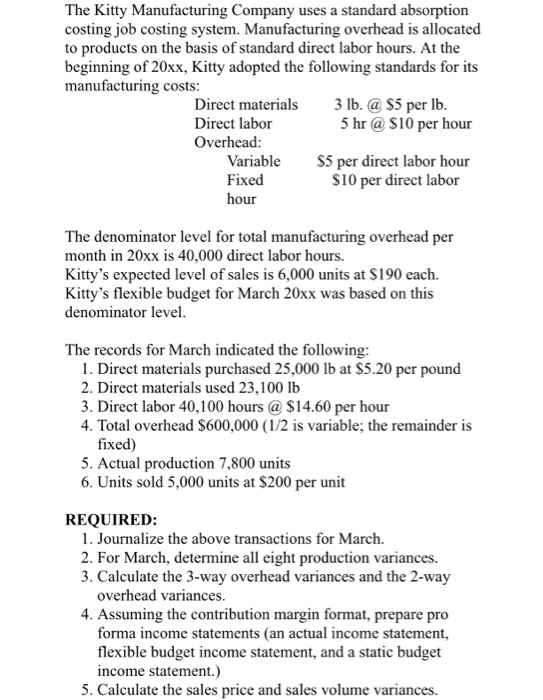

The Kitty Manufacturing Company uses a standard absorption costing job costing system. Manufacturing overhead is allocated to products on the basis of standard direct labor hours. At the beginning of 20xx, Kitty adopted the following standards for its manufacturing costs: Direct materials 3 lb. @ $5 per lb. Direct labor 5 hr @ $10 per hour Overhead: Variable $5 per direct labor hour Fixed $10 per direct labor hour The denominator level for total manufacturing overhead per month in 20xx is 40,000 direct labor hours. Kitty's expected level of sales is 6,000 units at $190 each. Kitty's flexible budget for March 20xx was based on this denominator level. The records for March indicated the following: 1. Direct materials purchased 25,000 lb at $5.20 per pound 2. Direct materials used 23,100 lb 3. Direct labor 40,100 hours @ $14.60 per hour 4. Total overhead $600,000 (1/2 is variable; the remainder is fixed) 5. Actual production 7,800 units 6. Units sold 5,000 units at $200 per unit REQUIRED: 1. Journalize the above transactions for March. 2. For March, determine all eight production variances. 3. Calculate the 3-way overhead variances and the 2-way overhead variances. 4. Assuming the contribution margin format, prepare pro forma income statements (an actual income statement, flexible budget income statement, and a static budget income statement.) 5. Calculate the sales price and sales volume variances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts