Question: Please solve asap Question 2 (4 Marks) Merah Berhad has made the following forecast for the upcoming year based on the company's current capitalization: Interest

Please solve asap

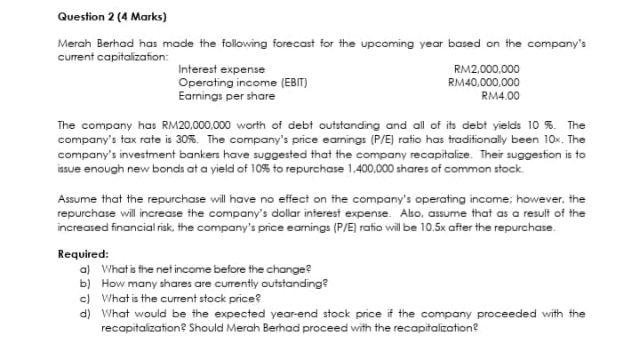

Question 2 (4 Marks) Merah Berhad has made the following forecast for the upcoming year based on the company's current capitalization: Interest expense RM2,000,000 Operating income (EBIT) RM40,000,000 Earnings per share RM4.00 The company has RM20,000,000 worth of debt outstanding and all of its debt yields 10 %. The company's tax rate is 30%. The company's price earnings (P/E) ratio has traditionally been 10x. The company's investment bankers have suggested that the company recapitalize. Their suggestion is to issue enough new bonds at a yield of 10% to repurchase 1,400,000 shares of common stock Assume that the repurchase will have no effect on the company's operating income, however, the repurchase will increase the company's dollar interest expense. Abo, assume that as a result of the increased financial risk, the company's price earnings (P/E) ratio wil be 10,5x after the repurchase. Required: a) What is the net income before the change? b) How many shares are currently outstanding c) What is the current stock price? d) What would be the expected year-end stock price if the company proceeded with the recapitalzation should Merah Berhad proceed with the recapitalization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts