Question: PLEASE SOLVE ASAP!! THANKS 4. Ms. Mary Kelley has initial wealth W. = $1200 and faces an uncertain future that she partitions into two states,

PLEASE SOLVE ASAP!! THANKS

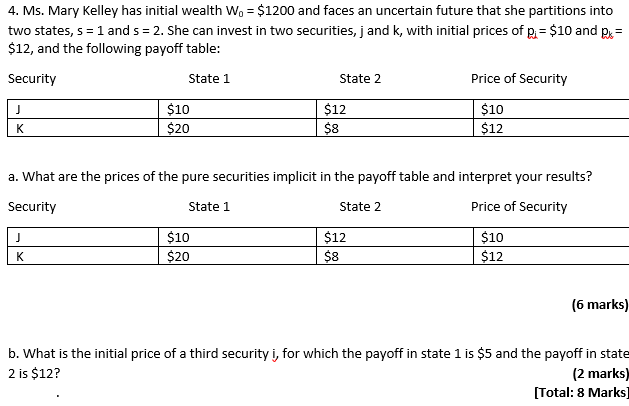

4. Ms. Mary Kelley has initial wealth W. = $1200 and faces an uncertain future that she partitions into two states, 5= 1 and 5= 2. She can invest in two securities, j and k, with initial prices of pi = $10 and 2x = $12, and the following payoff table: Security Price of Security State 1 State 2 J $10 $20 $12 $8 $10 $12 State 1 State 2 a. What are the prices of the pure securities implicit in the payoff table and interpret your results? Security Price of Security $10 $12 $10 $20 $8 $12 J (6 marks) b. What is the initial price of a third security i, for which the payoff in state 1 is $5 and the payoff in state 2 is $12? (2 marks) [Total: 8 Marks 4. Ms. Mary Kelley has initial wealth W. = $1200 and faces an uncertain future that she partitions into two states, 5= 1 and 5= 2. She can invest in two securities, j and k, with initial prices of pi = $10 and 2x = $12, and the following payoff table: Security Price of Security State 1 State 2 J $10 $20 $12 $8 $10 $12 State 1 State 2 a. What are the prices of the pure securities implicit in the payoff table and interpret your results? Security Price of Security $10 $12 $10 $20 $8 $12 J (6 marks) b. What is the initial price of a third security i, for which the payoff in state 1 is $5 and the payoff in state 2 is $12? (2 marks) [Total: 8 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts