Question: Please solve at earliest 5a) A 4 month call option with $60 strike price is currently selling at $5. The underlying stock price is $59.

Please solve at earliest

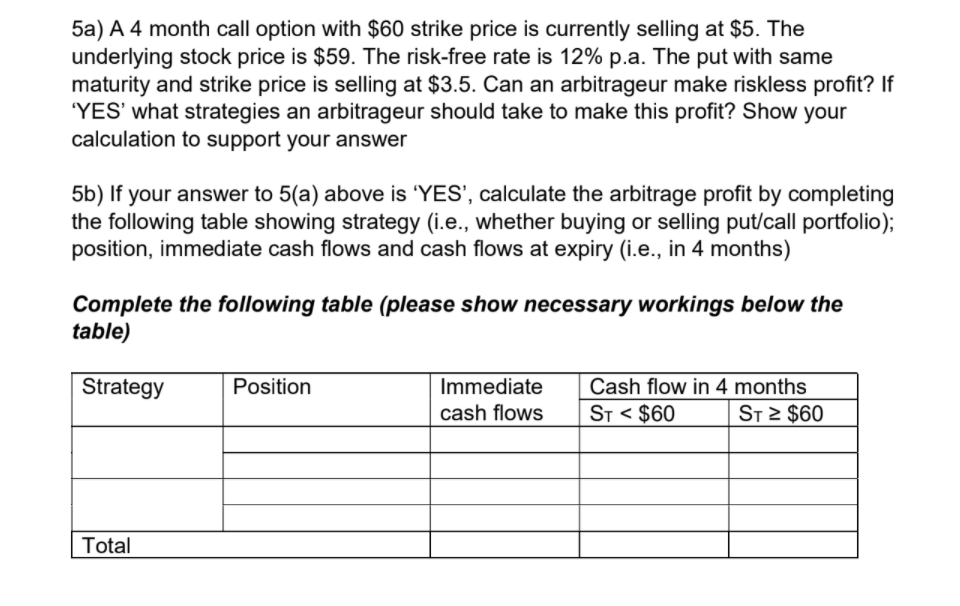

5a) A 4 month call option with $60 strike price is currently selling at $5. The underlying stock price is $59. The risk-free rate is 12% p.a. The put with same maturity and strike price is selling at $3.5. Can an arbitrageur make riskless profit? If 'YES' what strategies an arbitrageur should take to make this profit? Show your calculation to support your answer 5b) If your answer to 5(a) above is 'YES', calculate the arbitrage profit by completing the following table showing strategy (i.e., whether buying or selling put/call portfolio); position, immediate cash flows and cash flows at expiry (i.e., in 4 months) Complete the following table (please show necessary workings below the table) Strategy Position Immediate cash flows Cash flow in 4 months ST

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts