Question: Please solve ( b ) . Indigo Limited purchased an oil tanker depot on July 2 , 2 0 2 3 , at a cost

Please solve b

Indigo Limited purchased an oil tanker depot on July at a cost of $ and expects to operate the depot Indigo Limited purchased an oil tanker depot on July at a cost of $ and expects to operate the depot

for years. After the years, Indigo is legally required to dismantle the depot and remove the underground storage

tanks. It is estimated that it will cost $ to do this at the end of the depot's useful life. Indigo follows ASPE.

Click here to view the factor table.

Click here to view the factor table.

a

Your answer is correct.

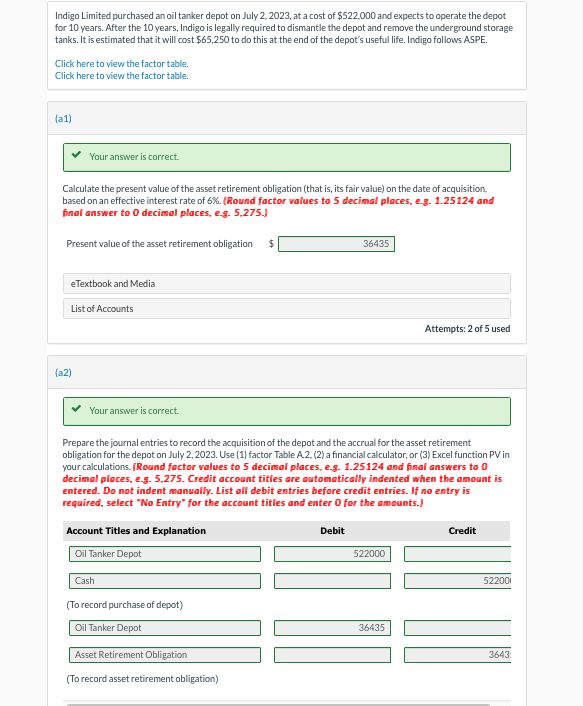

Calculate the present value of the asset retirement obligation that is its fair value on the date of acquisition,

based on an effective interest rate of Round factor values to decimal places, eg and

final answer to decimal places, eg

Present value of the asset retirement obligation

eTextbook and Media

List of Accounts

Your answer is correct.

Prepare the journal entries to record the acquisition of the depot and the accrual for the asset retirement

obligation for the depot on July Use factor Table A a financial calculator, or Excel function PV in

your calculations. Round factor values to decimal places, eg and final answers to

decimal places, eg Credit account titles are automatically indented when the amount is

entered. Do not indent manually. List all debit entries before credit entries. If no entry is

required, select No Entry" for the account titles and enter for the amounts.

Account Titles and Explanation

Credit

Oil Tanker Depot

To record purchase of depot

Oil Tanker Depot

Asset Retirement Obligation

To record asset retirement obligation

for years. After the years, Indigo is legally required to dismantle the depot and remove the underground storage

tanks. It is estimated that it will cost $ to do this at the end of the depot's useful life. Indigo follows ASPE.

Click here to view the factor table.

Click here to view the factor table.

a

Your answer is correct.

Calculate the present value of the asset retirement obligation that is its fair value on the date of acquisition,

based on an effective interest rate of Round factor values to decimal places, eg and

final answer to decimal places, eg

Present value of the asset retirement obligation

eTextbook and Media

List of Accounts

Your answer is correct.

Prepare the journal entries to record the acquisition of the depot and the accrual for the asset retirement

obligation for the depot on July Use factor Table A a financial calculator, or Excel function PV in

your calculations. Round factor values to decimal places, eg and final answers to

decimal places, eg Credit account titles are automatically indented when the amount is

entered. Do not indent manually. List all debit entries before credit entries. If no entry is

required, select No Entry" for the account titles and enter for the amounts.

Account Titles and Explanation

Credit

Oil Tanker Depot

To record purchase of depot

Oil Tanker Depot

Asset Retirement Obligation

To record asset retirement obligation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock