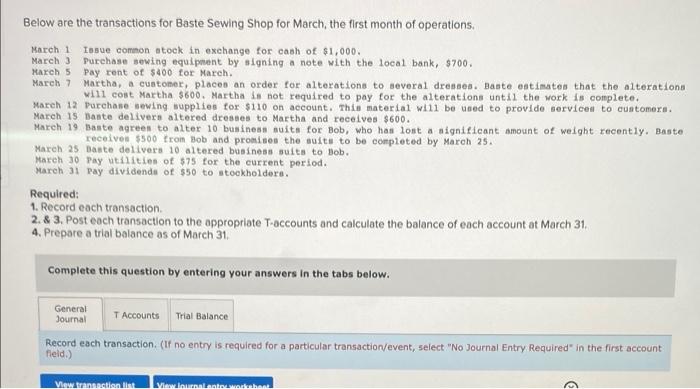

Question: please solve :) Below are the transactions for Baste Sewing Shop for March, the first month of operations. March 1 Issue common stock in exchange

Below are the transactions for Baste Sewing Shop for March, the first month of operations. March 1 Issue common stock in exchange for cash of $1,000 March ) Purehase sewing equipment by signing a note with the local bank, $700. March 5 Pay rent of $400 for March March 7 Martha, a customer, place an order for alterations to several dresses. Bante estimates that the alterations will cost Martha $600. Martha is not required to pay for the alterations until the work is complete. March 12 purchase sewing supplies for $110 on account. This material will be used to provide services to customers. March 15 Dante delivers altered dresses to Martha and receives $600. March 19 Baste agreen to alter 10 business nuits for Bob, who has lost a nignificant amount of weight recently. Basto receives $500 fron Bob and promises the suits to be completed by March 25. March 25 Bante delivers 10 altered business suits to Bob. March 30 Pay utilities of $75 for the current period. March 31 Pay dividends of $50 to stockholders. Required: 1. Record each transaction 2.&3. Post each transaction to the appropriate T-accounts and calculate the balance of each account at March 31, 4. Prepare a trial balance as of March 31 Complete this question by entering your answers in the tabs below. General T Accounts Trial Balance Journal Record each transaction (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction in Vinwouldhand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts