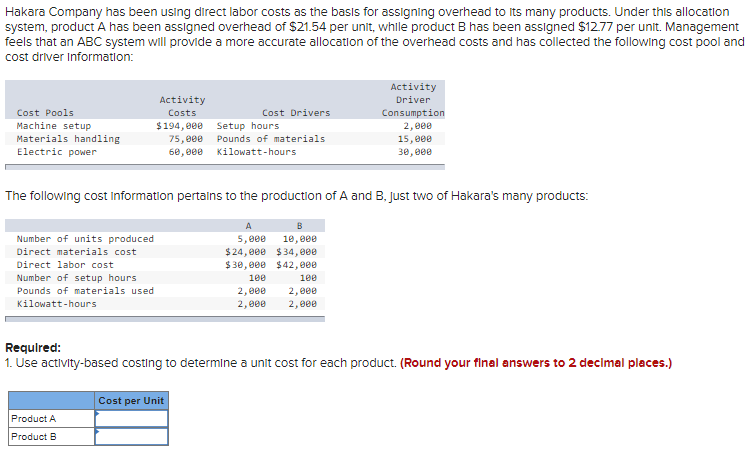

Question: Please solve below. CoursHeroTranscribedText: Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation

Please solve below.

CoursHeroTranscribedText: Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $21.54 per unit, while product B has been assigned $1277 per unit. Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver Information: Activity Activity Driver Cost Pools Costs Cost Drivers Consumption Machine setup $194,090 Setup hours 2,908 Materials handling 75,908 Pounds of materials 15, 080 Electric power 60, 090 Kilowatt- hours 30, Gee The following cost Information pertains to the production of A and B, just two of Hakara's many products: A B Number of units produced 5,090 10, 090 Direct materials cost $ 24, 090 $34, Gee Direct labor cost $30, 090 $42,090 Number of setup hours Pounds of materials used 2, 098 2,090 Kilowatt-hours 2,098 2,090 Required: 1. Use activity-based costing to determine a unit cost for each product. (Round your final answers to 2 decimal places.) Cost per Unit Product A Product B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts