Question: Please solve both for a thumbs up, please! Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over

Please solve both for a thumbs up, please!

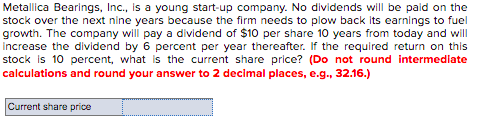

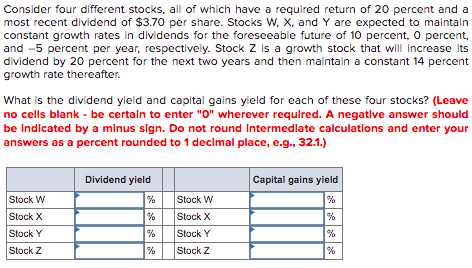

Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a dividend of $10 per share 10 years from today and will Increase the dividend by 6 percent per year thereafter. If the required return on this stock is 10 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share price Consider four different stocks, all of which have a required return of 20 percent and a most recent dividend of $3.70 per share. Stocks W, X, and Y are expected to maintain constant growth rates in dividends for the foreseeable future of 10 percent, o percent, and -5 percent per year, respectively. Stock Z is a growth stock that will increase its dividend by 20 percent for the next two years and then maintain a constant 14 percent growth rate thereafter. What is the dividend yield and capital gains yield for each of these four stocks? (Leave no cells blank - be certain to enter "o" wherever required. A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and enter your answers as a percent rounded to 1 decimal place, e.g., 32.1.) Dividend yield Stock w Stock X Stock Y Stock Z Capital gains yield % % % Stock W Stock X Stock Y Stock Z % % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts