Question: Please solve both for a thumbs up ! Required information [The following information applies to the questions displayed below] At the beginning of the year,

![following information applies to the questions displayed below] At the beginning of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e5de858ca07_74166e5de852664e.jpg)

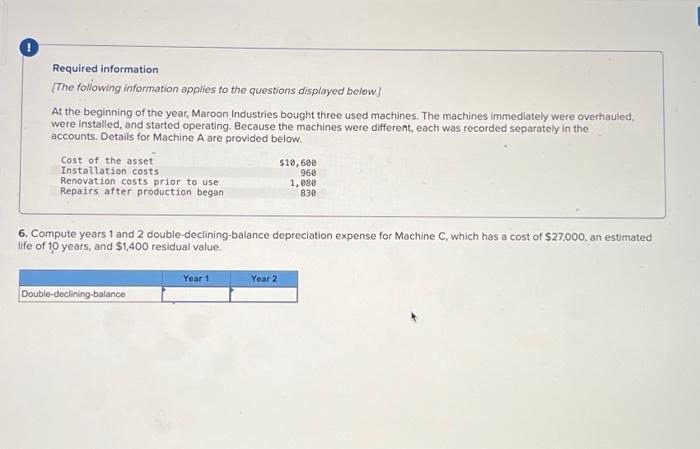

Required information [The following information applies to the questions displayed below] At the beginning of the year, Maroon Industries bought three used machines. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. Details for Machine A are provided below. Compute years 1 and 2 double-declining-balance depreciation expense for Machine C, which has a cost of $27,000, an estimated fe of 10 years, and $1,400 residual value. At the beginning of the year, Maroon Industries bought three used machines. The machines immediately were overhauled. were installed, and started operating. Because the machines were different, each was recorded separately in the accounts, Details for Machine A are provided below. Prepare the journal entry to record year 2 double-declining balance depreciation expense for Machine C, which has a cost of 27,000 , an estimated life of 10 years, and $1,400 residual value. (If no entry is required for a transaction/event, select "No Journal ntry Required" in the first account field.) Journal entry worksheet Record the year 2 depreciation expense for Machine C. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts