Question: Please solve both in Excel and show/explain how you solved the questions in Excel thank you! 6. On May 15, 2000, a company is interested

Please solve both in Excel and show/explain how you solved the questions in Excel thank you!

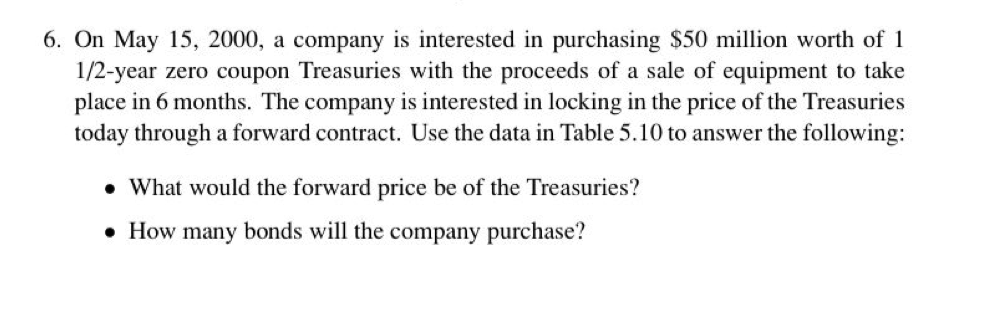

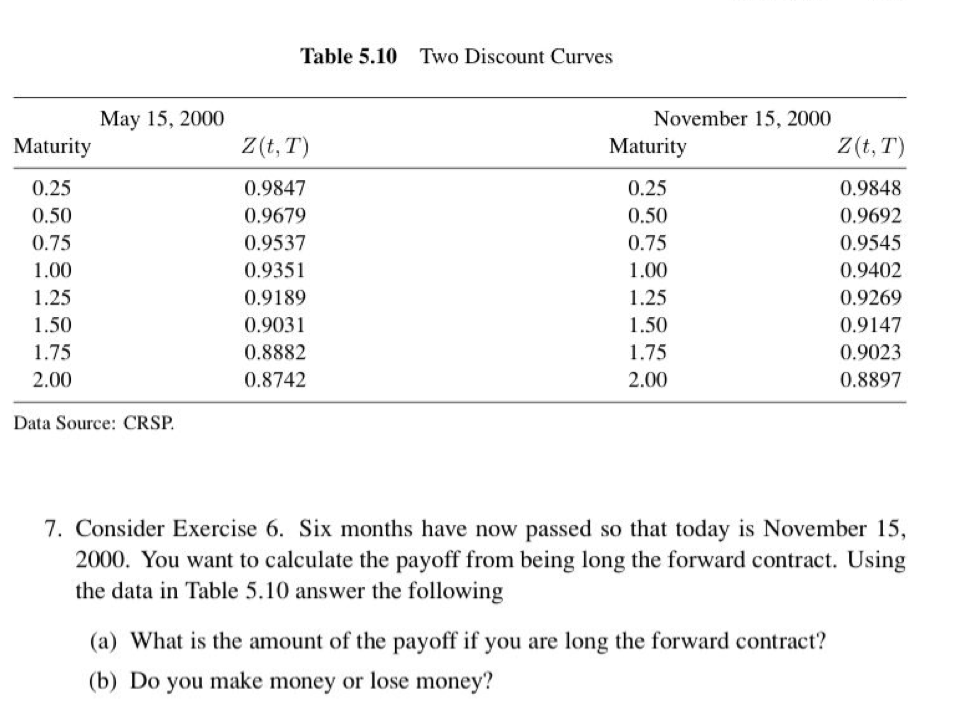

6. On May 15, 2000, a company is interested in purchasing $50 million worth of 1 1/2-year zero coupon Treasuries with the proceeds of a sale of equipment to take place in 6 months. The company is interested in locking in the price of the Treasuries today through a forward contract. Use the data in Table 5.10 to answer the following: What would the forward price be of the Treasuries? How many bonds will the company purchase? Table 5.10 Two Discount Curves May 15, 2000 Maturity Z(t, T) November 15, 2000 Maturity Z(t, T) 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 0.9847 0.9679 0.9537 0.9351 0.9189 0.9031 0.8882 0.8742 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 0.9848 0.9692 0.9545 0.9402 0.9269 0.9147 0.9023 0.8897 Data Source: CRSP. 7. Consider Exercise 6. Six months have now passed so that today is November 15, 2000. You want to calculate the payoff from being long the forward contract. Using the data in Table 5.10 answer the following (a) What is the amount of the payoff if you are long the forward contract? (b) Do you make money or lose money? 6. On May 15, 2000, a company is interested in purchasing $50 million worth of 1 1/2-year zero coupon Treasuries with the proceeds of a sale of equipment to take place in 6 months. The company is interested in locking in the price of the Treasuries today through a forward contract. Use the data in Table 5.10 to answer the following: What would the forward price be of the Treasuries? How many bonds will the company purchase? Table 5.10 Two Discount Curves May 15, 2000 Maturity Z(t, T) November 15, 2000 Maturity Z(t, T) 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 0.9847 0.9679 0.9537 0.9351 0.9189 0.9031 0.8882 0.8742 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 0.9848 0.9692 0.9545 0.9402 0.9269 0.9147 0.9023 0.8897 Data Source: CRSP. 7. Consider Exercise 6. Six months have now passed so that today is November 15, 2000. You want to calculate the payoff from being long the forward contract. Using the data in Table 5.10 answer the following (a) What is the amount of the payoff if you are long the forward contract? (b) Do you make money or lose money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts