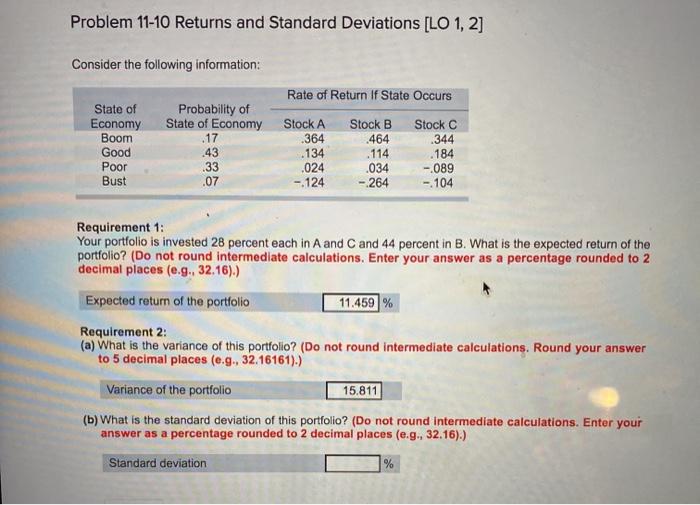

Question: please solve both problems Problem 11-10 Returns and Standard Deviations [LO 1, 2] Consider the following information: State of Economy Boom Good Poor Bust Probability

![1, 2] Consider the following information: State of Economy Boom Good Poor](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671408574d17b_10267140856d6fea.jpg)

Problem 11-10 Returns and Standard Deviations [LO 1, 2] Consider the following information: State of Economy Boom Good Poor Bust Probability of State of Economy .17 .43 .33 .07 Rate of Return If State Occurs Stock A Stock B Stock C .364 464 .344 .134 .114 .184 .024 .034 -089 -.124 - 264 -104 Requirement 1: Your portfolio is invested 28 percent each in A and C and 44 percent in B. What is the expected return of the portfolio? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (e.g., 32.16).) Expected return of the portfolio 11.459% Requirement 2: (a) What is the variance of this portfolio? (Do not round intermediate calculations. Round your answer to 5 decimal places (e.g., 32.16161).) Variance of the portfolio 15.811 (b) What is the standard deviation of this portfolio? (Do not round Intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (e.g., 32.16).) Standard deviation % 20) value: 2.00 points Problem 11-11 Calculating Portfolio Betas [LO 3] You own a stock portfolio invested 27 percent in Stock Q. 17 percent in Stock R, 43 percent in Stock S, and 13 percent in Stock T. The betas for these four stocks are 96, 1.02, 1.42, and 1.87, respectively. Required: What is the portfolio beta? (Do not round intermediate calculations. Round your answer to 2 decimal places (e.g. 32.16).) Portfolio beta Hints References eBook & Resources Hint #1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts