Question: Please solve both questions and try to give typed answer in a good language, i will really appreciate it, thanks 7) A) A company is

Please solve both questions and try to give typed answer in a good language, i will really appreciate it, thanks

Please solve both questions and try to give typed answer in a good language, i will really appreciate it, thanks

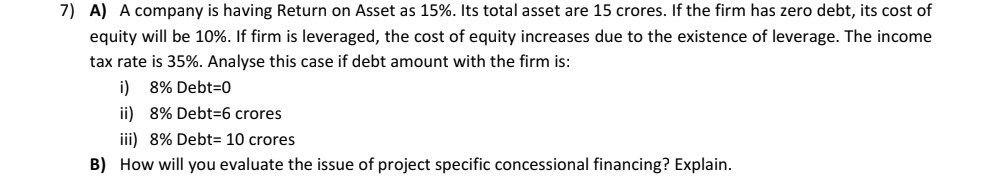

7) A) A company is having Return on Asset as 15%. Its total asset are 15 crores. If the firm has zero debt, its cost of equity will be 10%. If firm is leveraged, the cost of equity increases due to the existence of leverage. The income tax rate is 35%. Analyse this case if debt amount with the firm is: i) 8% Debt=0 ii) 8% Debt=6 crores iii) 8% Debt= 10 crores B) How will you evaluate the issue of project specific concessional financing? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts