Question: please solve both questions Excel Online Structured Activity: Statement of cash flows You have just been hired as a financial analyst for Barrington Industries. Unfortunately,

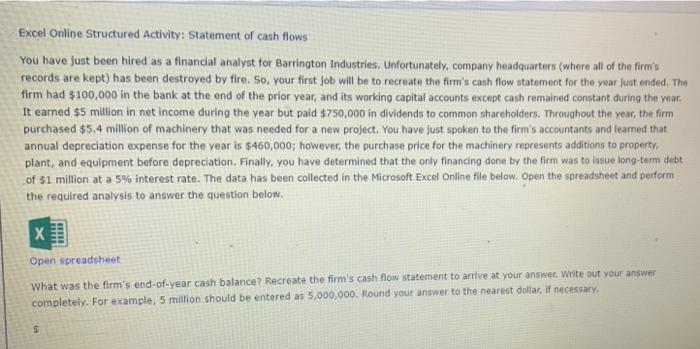

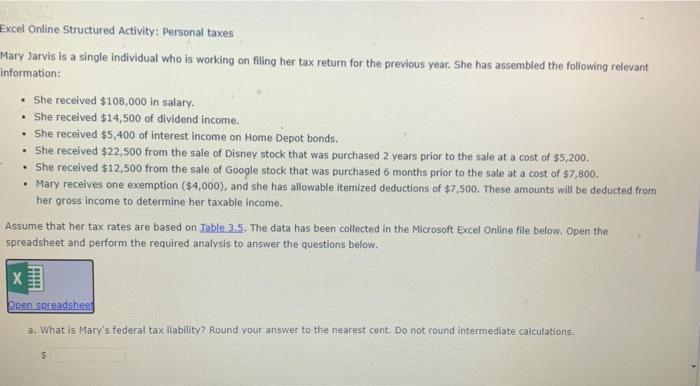

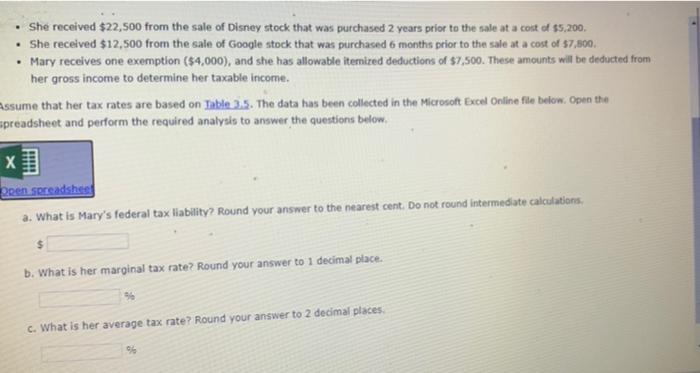

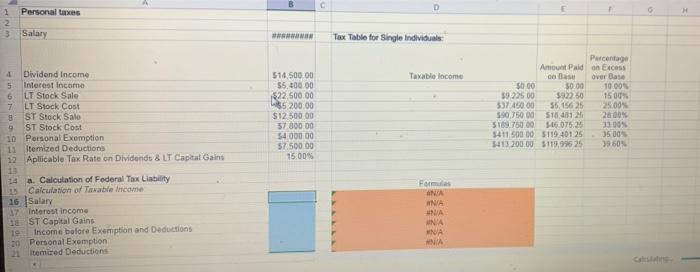

Excel Online Structured Activity: Statement of cash flows You have just been hired as a financial analyst for Barrington Industries. Unfortunately, company headquarters (where all of the firm's records are kept) has been destroyed by fire. So, your first Job will be to recreate the firm's canh flow statement for the year fust ended. The firm had $100,000 in the bank at the end of the prior year, and its working capital accounts except cash remained constant during the yoar. It earned $5 million in net income during the year but paid $750,000 in dividends to common shareholders. Throughout the year, the firm purchased $5.4 million of machinery that was needed for a new project. You have just spoken to the firm's accountants and leamed that annual depreciation expense for the year is $460,000; however, the purchase price for the machinery represents additions to property. plant, and equipment before depreciation. Finally, you have determined that the only financing done by the firm was to issue long-term debt of $1 million at a 5% interest rate. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsteet What was the firm's end-of-year cash balance? Recreate the firm's cash flow statement to arrive at your answer. Write out your answer completely. For example, 5 mition should be entered as 5,000,000. Round your answer to the nearest doliar, if necessary. Excel Online Structured Activity: Personal taxes Mary Jarvis is a single individual who is working on filing her tax return for the previous year, She has assembled the following relevant nformation: - She received $108,000 in salary. - She received $14,500 of dividend income. - She received $5,400 of interest income on Home Depot bonds. - She received $22,500 from the sale of Disney stock that was purchased 2 years prior to the 5ale at a cost of $5,200. - She recelved $12,500 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $7,800. - Mary receives one exemption ($4,000), and she has allowable itemized deductions of $7,500. These amounts will be deducted from her gross income to determine her taxable income. Assume that her tax rates are based on Table 3.5. The data has been coltected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. a. What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermediate caiculations. - She received $22,500 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $5,200. - She received $12,500 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $7,800. - Mary receives one exemption ($4,000), and she has allowable itemized deductions of $7,500. These amounts will be deducted from her gross income to determine her taxable income. ssume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Online file belon. Open the preadsheet and perform the required analysis to answer the questions below. a. What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermedate calculations. $ b. What is her maroinal tax rate? Round your answer to 1 decimal place. c. What is her average tax rate? Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts