Question: please solve both questions with the solution and step 2. Desert Innovation had one patent recorded on its books as of January 1, 2022. This

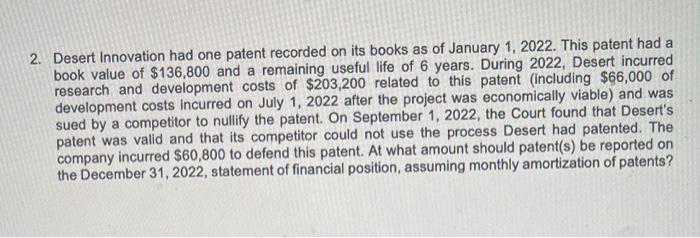

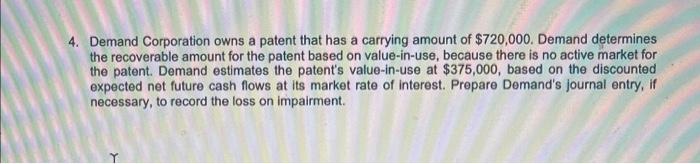

2. Desert Innovation had one patent recorded on its books as of January 1, 2022. This patent had a book value of $136,800 and a remaining useful life of 6 years. During 2022, Desert incurred research and development costs of $203,200 related to this patent (including $66,000 of development costs incurred on July 1, 2022 after the project was economically viable) and was sued by a competitor to nullify the patent. On September 1, 2022, the Court found that Desert's patent was valid and that its competitor could not use the process Desert had patented. The company incurred $60,800 to defend this patent. At what amount should patent(s) be reported on the December 31,2022 , statement of financial position, assuming monthly amortization of patents? Demand Corporation owns a patent that has a carrying amount of $720,000. Demand determines the recoverable amount for the patent based on value-in-use, because there is no active market for the patent. Demand estimates the patent's value-in-use at $375,000, based on the discounted expected net future cash flows at its market rate of interest. Prepare Demand's journal entry, if necessary, to record the loss on impairment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts