Question: please solve by equations (not tables or Excel) Question # 4: (25 Points) To conduct an economic analysis for an engineering project, XYZ company needs

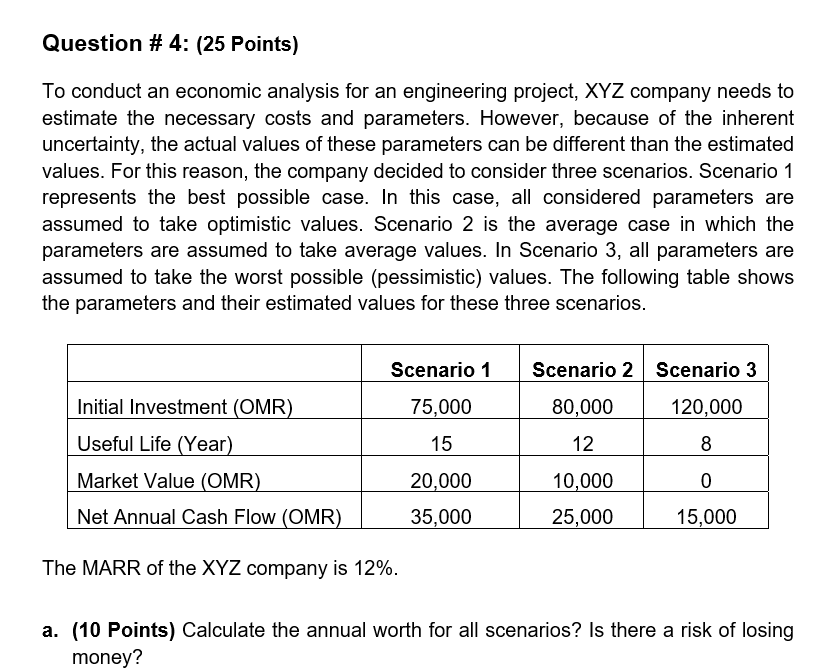

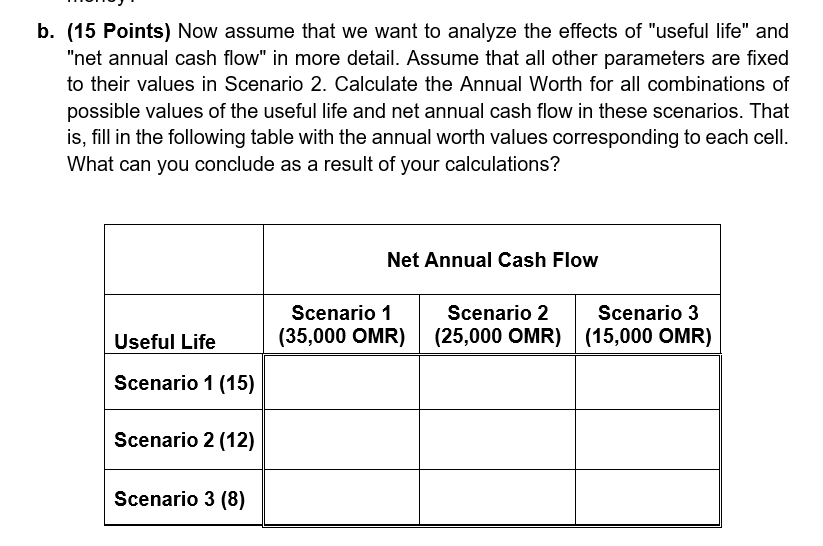

please solve by equations (not tables or Excel) Question # 4: (25 Points) To conduct an economic analysis for an engineering project, XYZ company needs to estimate the necessary costs and parameters. However, because of the inherent uncertainty, the actual values of these parameters can be different than the estimated values. For this reason, the company decided to consider three scenarios. Scenario 1 represents the best possible case. In this case, all considered parameters are assumed to take optimistic values. Scenario 2 is the average case in which the parameters are assumed to take average values. In Scenario 3, all parameters are assumed to take the worst possible (pessimistic) values. The following table shows the parameters and their estimated values for these three scenarios. Scenario 1 Scenario 2 Scenario 3 80,000 120,000 75,000 Initial Investment (OMR) Useful Life (Year) 15 12 8 0 Market Value (OMR) Net Annual Cash Flow (OMR) 20,000 35,000 10,000 25,000 15,000 The MARR of the XYZ company is 12%. a. (10 Points) Calculate the annual worth for all scenarios? Is there a risk of losing money? b. (15 Points) Now assume that we want to analyze the effects of "useful life" and "net annual cash flow" in more detail. Assume that all other parameters are fixed to their values in Scenario 2. Calculate the Annual Worth for all combinations of possible values of the useful life and net annual cash flow in these scenarios. That is, fill in the following table with the annual worth values corresponding to each cell. What can you conclude as a result of your calculations? Net Annual Cash Flow Scenario 1 (35,000 OMR) Scenario 2 Scenario 3 (25,000 OMR) (15,000 OMR) Useful Life Scenario 1 (15) Scenario 2 (12) Scenario 3 (8) please solve by equations (not tables or Excel) Question # 4: (25 Points) To conduct an economic analysis for an engineering project, XYZ company needs to estimate the necessary costs and parameters. However, because of the inherent uncertainty, the actual values of these parameters can be different than the estimated values. For this reason, the company decided to consider three scenarios. Scenario 1 represents the best possible case. In this case, all considered parameters are assumed to take optimistic values. Scenario 2 is the average case in which the parameters are assumed to take average values. In Scenario 3, all parameters are assumed to take the worst possible (pessimistic) values. The following table shows the parameters and their estimated values for these three scenarios. Scenario 1 Scenario 2 Scenario 3 80,000 120,000 75,000 Initial Investment (OMR) Useful Life (Year) 15 12 8 0 Market Value (OMR) Net Annual Cash Flow (OMR) 20,000 35,000 10,000 25,000 15,000 The MARR of the XYZ company is 12%. a. (10 Points) Calculate the annual worth for all scenarios? Is there a risk of losing money? b. (15 Points) Now assume that we want to analyze the effects of "useful life" and "net annual cash flow" in more detail. Assume that all other parameters are fixed to their values in Scenario 2. Calculate the Annual Worth for all combinations of possible values of the useful life and net annual cash flow in these scenarios. That is, fill in the following table with the annual worth values corresponding to each cell. What can you conclude as a result of your calculations? Net Annual Cash Flow Scenario 1 (35,000 OMR) Scenario 2 Scenario 3 (25,000 OMR) (15,000 OMR) Useful Life Scenario 1 (15) Scenario 2 (12) Scenario 3 (8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts