Question: Please solve by hand and show all steps: 1. Wedness Industries has forecasted its monthly needs for working capital (net of spontaneous sources, such as

Please solve by hand and show all steps:

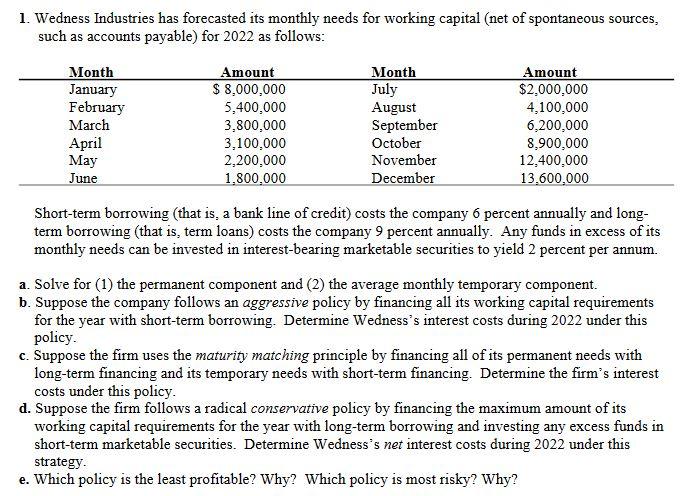

1. Wedness Industries has forecasted its monthly needs for working capital (net of spontaneous sources, such as accounts payable) for 2022 as follows: Month January February March April May June Amount $ 8,000,000 5,400,000 3,800,000 3,100,000 2,200,000 1.800,000 Month July August September October November December Amount $2,000,000 4,100,000 6,200,000 8,900,000 12,400.000 13,600,000 a Short-term borrowing (that is, a bank line of credit) costs the company 6 percent annually and long- term borrowing (that is, term loans) costs the company 9 percent annually. Any funds in excess of its monthly needs can be invested in interest-bearing marketable securities to yield 2 percent per annum. a. Solve for (1) the permanent component and (2) the average monthly temporary component. b. Suppose the company follows an aggressive policy by financing all its working capital requirements for the year with short-term borrowing. Determine Wedness's interest costs during 2022 under this policy. c. Suppose the firm uses the maturity matching principle by financing all of its permanent needs with long-term financing and its temporary needs with short-term financing. Determine the firm's interest costs under this policy. d. Suppose the firm follows a radical conservative policy by financing the maximum amount of its working capital requirements for the year with long-term borrowing and investing any excess funds in short-term marketable securities. Determine Wedness's net interest costs during 2022 under this strategy. e. Which policy is the least profitable? Why? Which policy is most risky? Why? 1. Wedness Industries has forecasted its monthly needs for working capital (net of spontaneous sources, such as accounts payable) for 2022 as follows: Month January February March April May June Amount $ 8,000,000 5,400,000 3,800,000 3,100,000 2,200,000 1.800,000 Month July August September October November December Amount $2,000,000 4,100,000 6,200,000 8,900,000 12,400.000 13,600,000 a Short-term borrowing (that is, a bank line of credit) costs the company 6 percent annually and long- term borrowing (that is, term loans) costs the company 9 percent annually. Any funds in excess of its monthly needs can be invested in interest-bearing marketable securities to yield 2 percent per annum. a. Solve for (1) the permanent component and (2) the average monthly temporary component. b. Suppose the company follows an aggressive policy by financing all its working capital requirements for the year with short-term borrowing. Determine Wedness's interest costs during 2022 under this policy. c. Suppose the firm uses the maturity matching principle by financing all of its permanent needs with long-term financing and its temporary needs with short-term financing. Determine the firm's interest costs under this policy. d. Suppose the firm follows a radical conservative policy by financing the maximum amount of its working capital requirements for the year with long-term borrowing and investing any excess funds in short-term marketable securities. Determine Wedness's net interest costs during 2022 under this strategy. e. Which policy is the least profitable? Why? Which policy is most risky? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts